AI Race, Google's Stock Is By Far A Much Better Investment Than ...

The two advertising giants, Alphabet (NASDAQ: GOOG)(NEOE: GOOG:CA) and Meta (META)(META:CA), are in a tight race to build versatile AI models and effectively deploy them across their platforms, in order to keep users engaged and the ad dollars flowing. Meta has been trumpeting the capabilities of its latest Llama 3 model, while Google recently introduced the powerful Gemini 1.5 Pro model. Both tech behemoths boast massive user bases that allow for wide-scale distribution of their models. Although only one is worth buying, and that is Alphabet stock.

Google's AI Advancements

In the previous article about Google, we covered how Google Cloud is becoming more profitable. In a simplified manner, I delved into specific technical concepts like “compute-optimal scaling” that has enabled Alphabet to train and deploy its models more cost-efficiently, conducive to widening profit margins for its cloud segment. Now aside from Google Cloud, these strategies also enable the tech giant to serve generative AI-powered searches more cost-efficiently.

Monetization Strategies

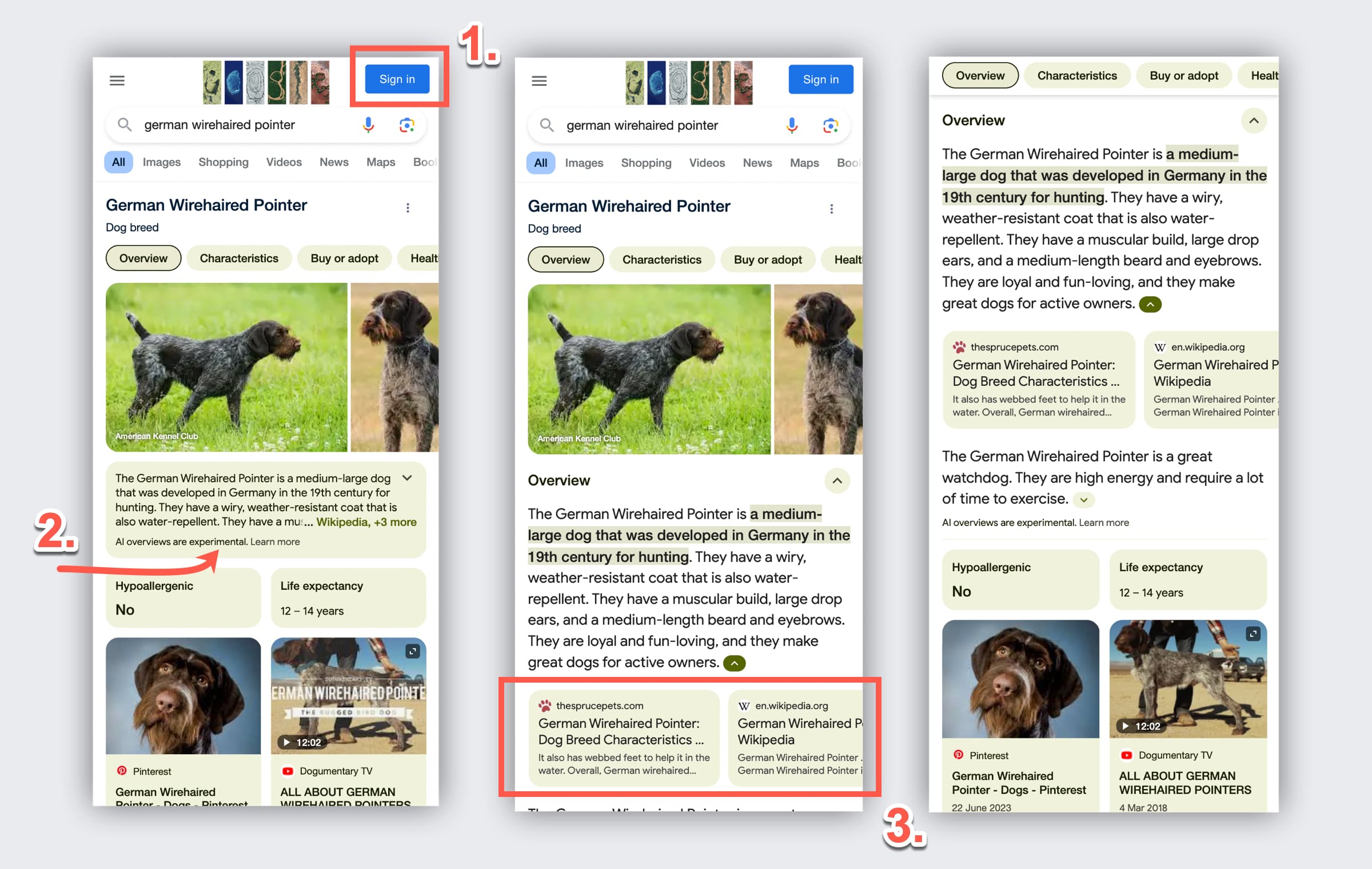

At the recent Google I/O event, Google revealed the roll out of AI Overviews in Google Search to all U.S. users, and that the company would roll it out to other countries more broadly over the coming months, to about 1 billion users by the end of the year. It will be powered by a custom Gemini model that is specifically tailored for Google Search.

On the Q1 2024 Google earnings call, CEO Sundar Pichai had shared that: "We have already served billions of queries with our generative AI features. It's enabling people to access new information, to ask questions in new ways, and to ask more complex questions."

Google vs. Meta

Moreover, Google would not be rolling out AI Overviews broadly if it wasn’t confident that it can adequately monetize the new search format. On the other hand, Meta is warning of revenue displacement risk as it rolls out its own generative AI features like the Meta AI assistant chatbot. Hence, at least over the near-term, Google appears to be better positioned than Meta in terms of yielding a return on investment for shareholders from all that AI-focused infrastructure spending.

Monetization Challenges

Now it might be confusing to keep track of the different Gemini-powered services that Google is offering. On the one hand there is AI Overviews, which is essentially the evolution of the traditional Search engine, and will continue to be monetized through advertisements. And then on the other hand there is also the Gemini app, a conversational chatbot in response to OpenAI’s ChatGPT.

Furthermore, Google also introduced “Project Astra” at the I/O event, which is the personal AI agent that one can conversate with verbally, showing incredible capabilities in terms of spatial understanding, video processing and memory.

Meta's Approach

With regards to Meta, the company has also introduced its own chatbot called ‘Meta AI assistant’, and Zuckerberg had discussed on the last earnings call that they also plan to evolve this chatbot feature into an AI-powered agent that can help users complete more complicated, multi-step tasks.

Future Outlook

In terms of Meta AI assistant competing against Google’s AI Overviews for user engagement and ad dollars going forward, Google’s advantage lies in the fact that it simply offers a much broader suite of consumer applications that can be leveraged to provide users with more contextually valuable responses.

Google even boasted how it can incorporate the extensive information it holds on all the businesses indexed on Google search, such as business ratings, reviews and opening hours.

Owning the largest video-sharing platform in the world is likely to be a big advantage for Google in this AI revolution.

However, Google’s YouTube simply has a much larger collection and wider range of videos to leverage for a variety of different use cases.