Top 4 Artificial Intelligence (AI) ETFs in 2025 | The Motley Fool

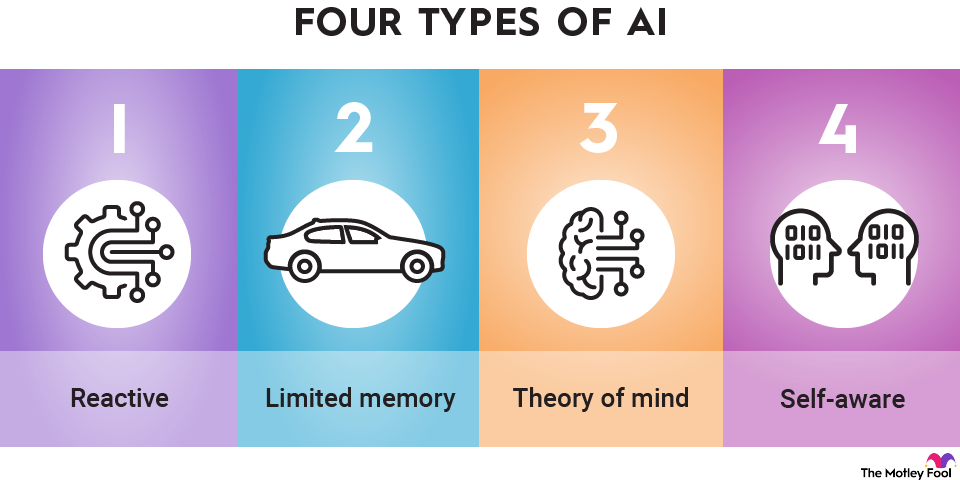

Artificial intelligence (AI) is increasingly prevalent in our daily lives, from powering the algorithms of streaming services like Netflix to enhancing the efficiency of e-commerce giants like Amazon. As AI technology continues to advance, investing in AI companies through exchange-traded funds (ETFs) can be a strategic way to gain exposure to this innovative sector without the need to select individual stocks.

Global X Robotics & Artificial Intelligence ETF (BOTZ)

Established in 2016, the Global X Robotics & Artificial Intelligence ETF (BOTZ) is focused on companies at the forefront of robotics and artificial intelligence. With investments in industrial robotics, automation, nonindustrial robots, and autonomous vehicles, this ETF offers a diversified portfolio of 46 stocks. Despite its underperformance compared to the S&P 500 since inception, BOTZ remains a growth-oriented investment option with a modest dividend yield and an expense ratio of 0.68%.

ROBO Global Robotics and Automation Index ETF (ROBO)

The ROBO Global Robotics and Automation Index ETF (ROBO) targets companies driving transformative innovations in robotics, automation, and AI. This ETF holds 77 different stocks, with a focus on AI, cloud computing, and other technology sectors. While ROBO has also underperformed the S&P 500, it offers a dividend yield of 0.55% and has an expense ratio of 0.95%.

iShares Future AI & Tech ETF (ARTY)

The iShares Future AI & Tech ETF (ARTY), previously known as IRBO, was established in 2018 to track the performance of companies poised to benefit from robotics and AI opportunities. With 50 stock holdings, ARTY provides exposure to fast-growing small-cap companies and has a competitive expense ratio of 0.47%. Despite its underperformance relative to the S&P 500, ARTY offers long-term growth potential for investors interested in the AI sector.

First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT)

The First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT) follows the Nasdaq CTA Artificial and Robotics index, which includes companies engaged in AI and robotics across various sectors. With 101 stock holdings, including top companies like Palantir, ROBT offers investors a diversified approach to AI investing. By considering factors such as expense ratios, dividend yields, and past performance, investors can select the AI ETF that aligns with their investment goals and risk tolerance.

As the field of AI continues to evolve and expand, investing in AI-focused ETFs can provide a strategic way to capitalize on the growth potential of this innovative sector. By diversifying across multiple AI ETFs, investors can mitigate risk and position themselves for long-term success in the rapidly advancing world of artificial intelligence.