The metrics that matter

Last week, while all eyes were on the cabinet meeting in Islamabad’s Convention Center and the government’s flagship metrics, which showed a rising stock market and higher foreign exchange earnings, the factors affecting people’s moods played out elsewhere.

So, rather than be distracted by the excitement around the flagship metrics, as a useful corrective, it makes more sense to face the conditions in our country honestly. The point is not to pour cold water over the government’s achievements, but to look at the baseline metrics. These metrics matter and are those against which the government's performance should be judged -- the data points that show whether people’s lives have improved or not.

The stark reality

The picture we then see is at odds with the flagship metrics: Millions of families are distressed by the times, caught in a downward spiral, finding it hard to stay afloat in the troubled economic waters. The nasty slump inflicted on us, as reflected, for instance, in the negative growth of manufacturing in seven of the past nine quarters, the sharp Rupee devaluation, and cramming down spending, aka ‘stabilisation measures’ and ‘shock therapy', have broken any number of records: in terms of the number of people pushed below the poverty line (13 million), the number of children not in school (over 26 million), the percentage of malnourished children (17.7 per cent) which exceeds the emergency threshold, and the number of hungry people (4 in every 5).

Our levels of poverty, illiteracy, child malnutrition, and hunger set us far apart from the rest of the world. But even as the Convention Center meeting struck sunny chords of optimism about good days to come in 2047, it was oddly detached from the concerns roiling the people.

Wealth disparity and economic policies

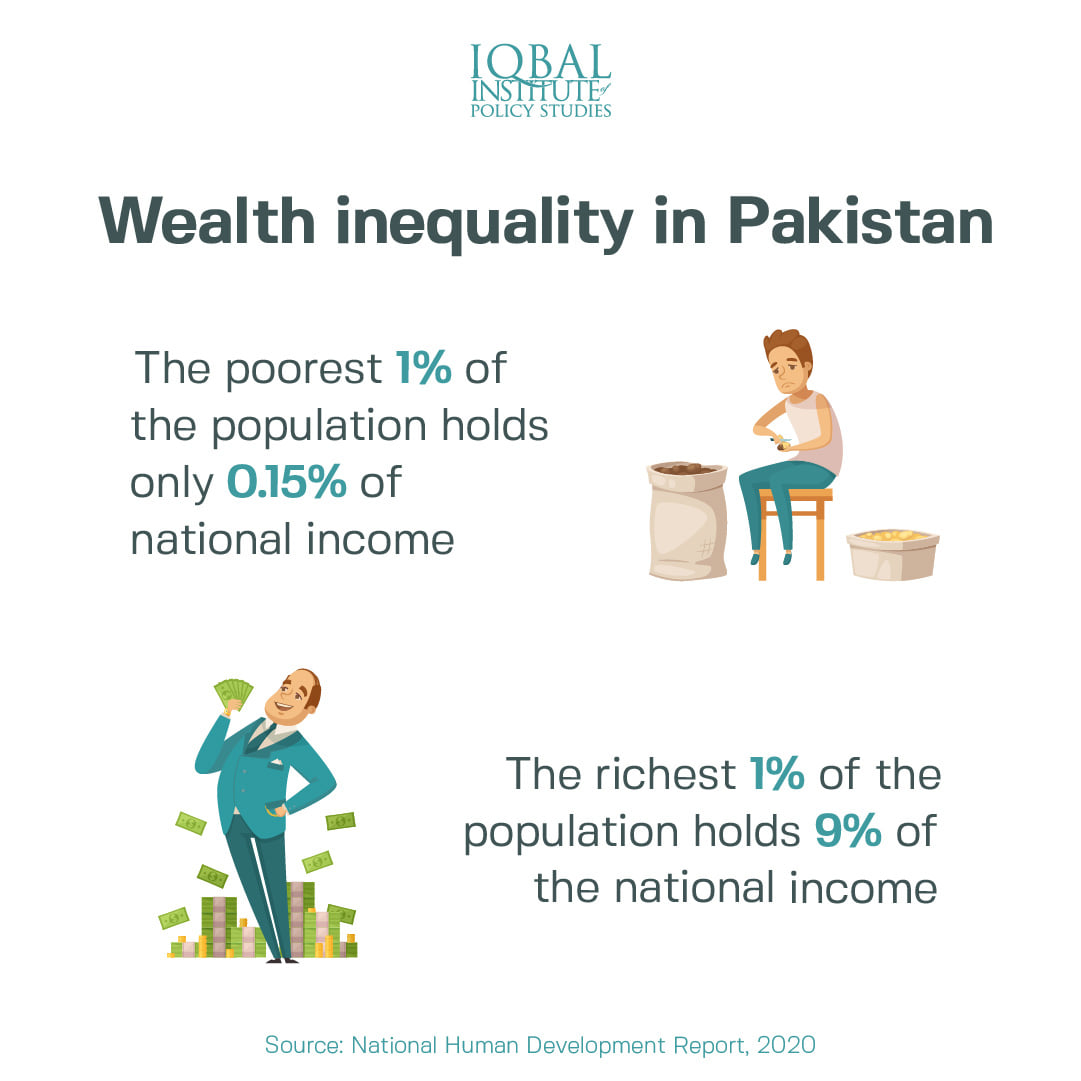

Meanwhile, a few owners of ten banks doubled their profits to Rs1 trillion last year from two years ago, even as the economic pie shrank in 2023 and grew by less than 2.5 per cent in 2024. This means national wealth is being transferred from the poor to the very rich.

How did they do it? Economic pundits call it financial deepening. And Moody’s calls it ‘resilient performance'. Others call it an overeager policy alignment with bank profits bordering on fraud, scam, and theft of public money. The run-up in stock prices is likewise padding the accounts of the rich. Letting inequality run amok also sets us apart from the rest of the world.

The need for change

Naturally, the Pakistani people who pay the price of poor governance in low wages and weak social protections sense that things are deeply wrong. They feel that the country is not being governed for them but for a few well-connected insiders who gain by imposing massive costs on everybody else.

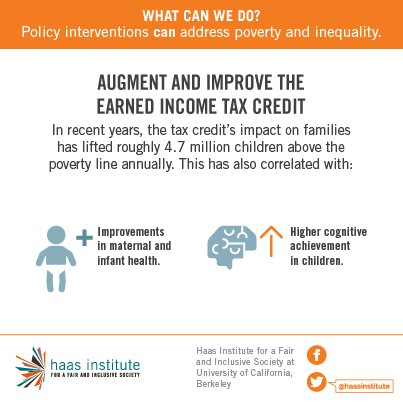

We need a dynamic government that sidelines the current ideological attachment to yesterday’s right-wing notions of free markets. One that builds wherever there is stagnation or chances of rapid growth and higher productivity: social and economic infrastructure, manufacturing, new technologies and artificial intelligence.

Yet, in these areas, the government has little by way of convincing plans. So long as this is the case, the people’s frustration will continue to simmer, destroying political legitimacy. And politicians waiting in the wings, caged or otherwise, even more right-wing than the current lot in power, will harness the frustration.