How much is ChatGPT creator OpenAI worth after its latest funding ...

Welcome to The Globe and Mail’s business and investing news quiz. Join us each week to test your knowledge of the stories making the headlines. Our business reporters come up with the questions, and you can show us what you know.

This week:

The union representing Montreal dockworkers staged a three-day strike at two terminals. The Maritime Employers Association stopped work at the Viau and Maisonneuve terminals, which combined handle more than 40 per cent of container traffic at the country’s second-largest port. The three-day job action by a quarter of the port’s 1,200 loaders and checkers began Monday, one day before dockworkers began a strike at three-dozen ports in the United States.

But while the shipping containers stopped moving this week, there was plenty of action in other parts of the business world, from hockey equipment makers to the Chinese stock market.

Recent Business Developments:

CCM. Altor, owner of the Rossignol ski brand, bought CCM, Canada’s oldest hockey-equipment maker. Altor hopes to expand sales of hockey gear to women and to first-generation immigrants.

Bauer Hockey. Fairfax will assume control of Bauer when the transaction closes later this year. It did not reveal the value of the deal.

‘Spoofing’ it. TD Securities USA, a unit of TD, admitted to “spoofing” the U.S. Treasuries market, according to a court filing on Monday. Spoofing is a way of manipulating the market by entering orders that are not intended to be executed. The bogus orders can create a false appearance of demand.

Britain's last coal-fired generating plant closed on Monday. The Ratcliffe-on-Soar station near Nottingham opened in 1967 and once employed as many as 3,000 workers.

Lack of ambition. Mr. Finkelstein told a tech conference in Toronto this week that Canadian entrepreneurs lack ambition compared with their U.S. counterparts and have a reputation for selling their businesses to larger competitors rather than attempting to grow them.

Key Financial Update:

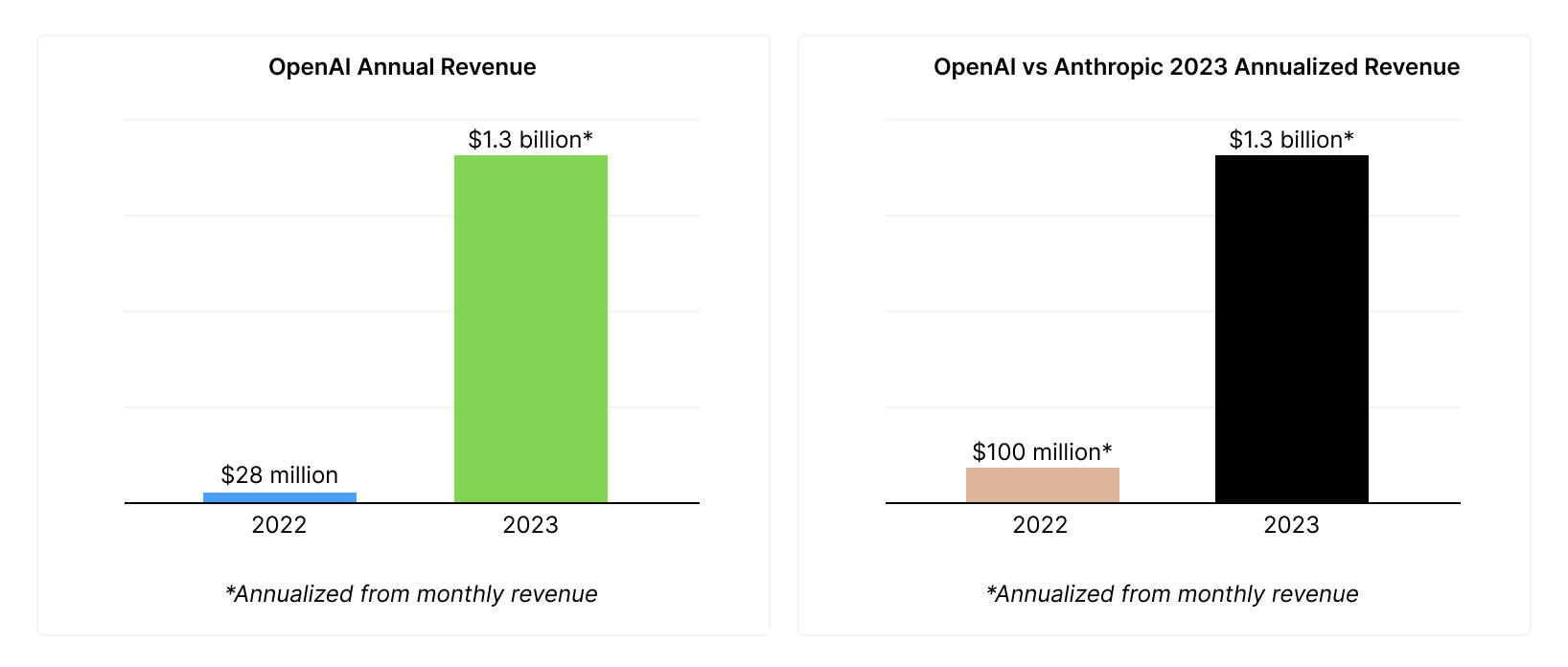

US$157-billion. Now pegged at US$157-billion, OpenAI is one of the most valuable private companies in existence. However, the U.S. start-up expects to lose US$5-billion this year. It has suffered a rash of executive departures and is facing growing competition from other AI companies.

For more information about other recent developments, visit the provided links. Stay informed about the latest business and investing news with The Globe and Mail.