I Let ChatGPT Review My Retirement Plan | GOBankingRates

When it comes to planning for retirement, it's essential to make informed decisions. Recently, I decided to try something different and sought the help of ChatGPT to review my retirement plan. The experience was eye-opening and provided valuable insights that I had not considered before.

Understanding the Importance of Financial Planning

Financial planning is crucial for a secure retirement. It involves setting specific goals and creating a roadmap to achieve them. From managing debt to maximizing savings and investments, every aspect plays a vital role in ensuring a comfortable and stress-free retirement.

ChatGPT's Review Process

ChatGPT analyzed my current financial situation, retirement goals, and investment portfolio. It highlighted areas where I could improve, suggested alternative investment strategies, and provided recommendations on how to optimize my retirement plan for better returns.

Key Takeaways

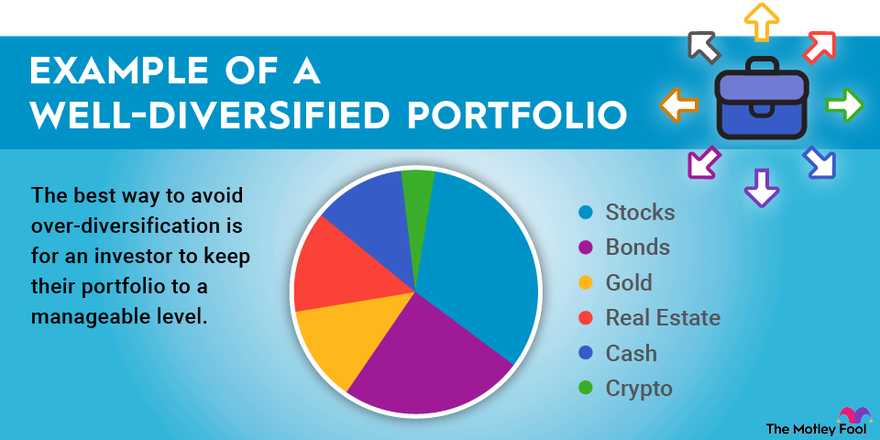

After ChatGPT's review, I realized the importance of diversifying my investment portfolio to minimize risk. It also emphasized the need to regularly review and adjust my retirement plan based on changing circumstances and financial goals. ChatGPT's insights were invaluable in helping me make more informed decisions about my retirement savings.

Planning for a Secure Retirement

Planning for retirement can seem overwhelming, but with the right tools and guidance, it becomes more manageable. Whether you're just starting or reassessing your existing plan, seeking expert advice, like ChatGPT's review, can provide clarity and peace of mind as you work towards a financially secure retirement.

Remember, the key to a successful retirement plan is starting early, staying informed, and being willing to adapt to changing financial landscapes. With the right strategies in place, you can build a solid foundation for a comfortable and enjoyable retirement.