Revolutionizing finance with conversational AI: a focus on ChatGPT

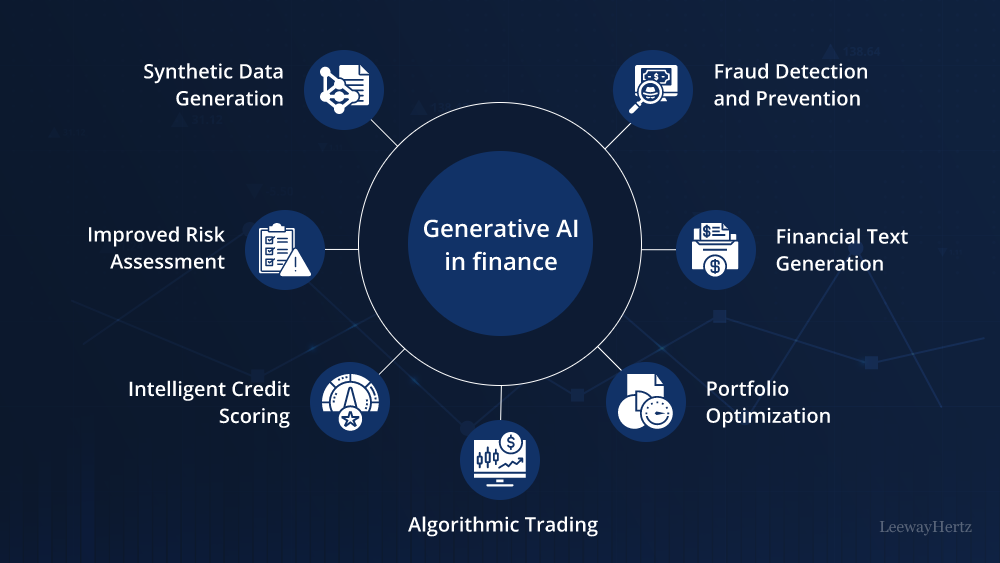

This study aims to investigate the application and management strategies of ChatGPT in financial services. We explore the potential of ChatGPT in financial customer service, financial planning, risk management, portfolio analysis, insurance services, and fraud prevention, for which it is found to provide efficient automated solutions for financial institutions. To successfully implement ChatGPT applications, we emphasize the importance of managing conversational AI, including clarifying business requirements, identifying application scenarios, building appropriate data models, ensuring security and privacy, performing manual supervision, and establishing evaluation and feedback mechanisms.

Besides, we also analyze the challenges and limitations of ChatGPT in the financial business, such as data trustworthiness, data privacy and security issues, model bias, and regulatory and compliance issues. Under this foundation, we propose corresponding solutions. Finally, we look forward to the future development of ChatGPT in the financial domain and make corresponding practical suggestions to help financial institutions better utilize ChatGPT technology.

Financial Technology (FinTech) and Digital Transformation

Financial Technology (FinTech) is defined as applying digital technology in the financial business to provide innovative financial products and services. With the advancement of digital technology, the global FinTech market has been growing at a rate over the past few years. It highlights the potential of digital technology in the financial sector.

There are many successful cases of fintech innovations. For example, Alipay and WeChat Pay have become popular in China and are the primary payment methods for daily consumption. Additionally, offering clients diverse portfolios using intelligent investing platforms like Betterment and Wealthfront has altered conventional investment notions.

The financial industry has seen significant shifts because of digital technology. Exploring ways to use digital technology has emerged as a key study area to improve further financial services and products.

The Role of ChatGPT in Financial Services

In the financial industry, ChatGPT can be used in various ways. By automating client query responses, financial institutions may increase customer service effectiveness, save staff expenses, and improve user experience. It may also predict and analyze data to assist financial organizations in better understanding market trends and investment possibilities. Additionally, ChatGPT may provide clients with individualized financial advice, delivering exact direction depending on client preferences. Finally, ChatGPT is crucial to risk management since it offers information to assist financial professionals with risk analysis and evaluation.

However, care must be taken to ensure the confidentiality and safety of financial data while using ChatGPT in the financial sector. Data encryption, access control, and authentication are necessary during model training to reduce the danger of information leakage and hacking. The interpretability of models is also an important issue. Interpretability helps financial practitioners understand the model’s decision-making process, reduce uncertainty, and increase trust in the model output.

Significance and Future of ChatGPT in Finance

The study of ChatGPT is of great significance in the financial field. It enhances customer experience, personalizes services, and helps users understand financial products and investment opportunities while strengthening the risk management capabilities of financial institutions. Moreover, this research is expected to contribute to FinTech development and promote the financial industry’s success in the digital era.

Some gaps in ChatGPT research need to be filled in the financial sector. There are limited empirical studies, and more verification of its practical effects is needed. Beyond that, there are still challenges in understanding complex financial contexts and providing accurate risk assessments. Therefore, further research should focus on filling these gaps to enhance the ability of ChatGPT in finance.

Research Questions and Methodology

To address these gaps, this study focuses on the following research questions:

- How effective is ChatGPT in improving customer service efficiency in financial institutions?

- What methodologies can be employed to build and optimize ChatGPT for financial risk assessment?

- How can financial institutions ensure data privacy and security while deploying ChatGPT?

- What strategies can mitigate model bias and ensure the ethical use of ChatGPT in financial services?

This study will proceed by introducing how ChatGPT works and summarizing the related research literature. The next section will introduce the research method. Subsequently, we will delve into the practical application of the technology in financial services and explore the management of AI applications in financial services organizations. Besides, the study will also discuss the ethical considerations involved in applying ChatGPT. Finally, it will present an agenda for future research to promote the further development of ChatGPT in financial services.

Understanding ChatGPT in Finance

ChatGPT is a deep learning-based language model that uses the transformers model architecture for powerful language generation and comprehension. Learning takes place through...