AI: Weekly Summary. RTZ #451. … week ending August 16, 2024

2. Google Structural vs Behavioral Remedies phase: The focus is shifting to the Remedies phase on Google’s historic antitrust loss on its Search distribution deals with Apple and others. These include considering ‘structural’ and ‘behavioral’ remedies, with the former involving possible breakup of the company’s key assets. There are many issues at play here, and likely months of appeals and rulings. The underlying issues have a number of contradictions that have to be thought through. Also of importance are the other antitrust cases in play against big tech that also may have a bearing on this case and its possible resolution. More here.

3. Nvidia’s software moat: Nvidia continues to weather recent market volatility, while driving the supply chain for next generation AI GPU chips and infrastructure. And the debates continue on its ability to leverage its position beyond chips vs ramping competitors. The company’s software moat extends beyond is open source AI infrastructure software CUDA frameworks, including software libraries that span dozens of industries and verticals. All optimized to work on Nvidia’s ‘Accelerated Computing’ AI superclusters, and DGX/NIMs data center infrastructure. Collectively, it all points to a vertical tech stack that rivals platforms like ‘Wintel’ in the PC/Internet tech waves of the 80s and 90s. More here.

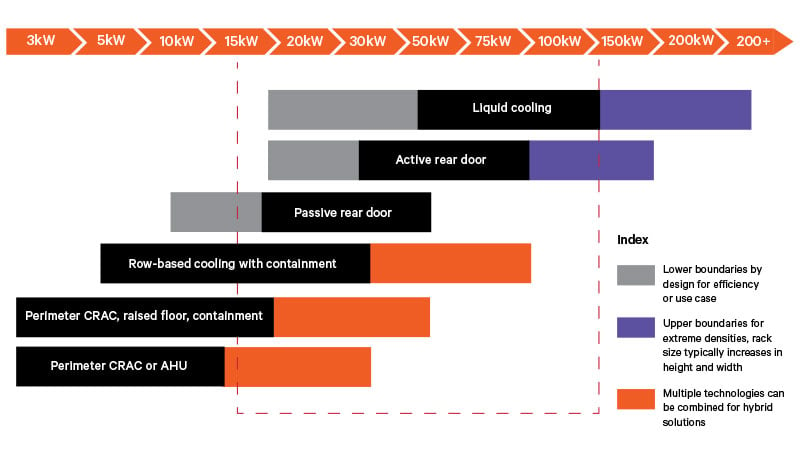

4. Challenge of Cooling AI data centers: One of the next set of challenges in AI data center infrastructure beyond supply constraints of AI GPUs, Power, and talent, is the escalating need to cool the next generation of AI GPUs Compute superclusters around Nvidia’s Blackwell chips. Cooling is transitioning from air-cooled to liquid-cooled requirements in the next generation AI data centers. That will provide dramatically more compute with meaningful power efficiencies. But this is more complex and expensive relative to prior technologies. And it requires hiring a large number of trained ‘data technicians’ to run the ever-more critical AI data centers. It’s the next major input that needs to be managed while Scaling AI to the next levels. More here.

5. China’s sourcing of Nvidia chips: China continues to seek large supplies of US AI chips and infrastructure, and an industry has emerged to meet that demand despite rising US tech export curbs. This despite efforts by Nvidia and others to ramp up China qualified AI chips and infrastructure exports. As well as US AI cloud data center companies ramping up to meet China demand. Also notable is China’s tech companies like Huawei ramping up new AI Chips to challenge Nvidia and others in China and beyond. China remains the number two global competitor for the US in AI, despite its unique internal AI market dynamics. All of the above of course persists in the context of the broader US/China ‘threading the needle’ efforts on the geopolitics around national security, tech, and trade. More here.

Other AI Readings for weekend: Notable AI report from Wharton illustrating why AI in Education is an evolutionary process. Likely applies to other verticals like Healthcare, Legal and others as well.

![PDF] Regulating Online Platforms: Lessons from 100 years of ...](https://d3i71xaburhd42.cloudfront.net/bb2dec90174de6efcc1c29850ad253d3c494a159/54-Figure1-1.png)