AMD and Meta Platforms: Rosenblatt's Top Picks for AI-Driven Growth

AMD and Micron are among the top analyst picks for AI and next-generation tech growth, according to Rosenblatt's analysis. The stocks highlighted by Rosenblatt reflect key themes in the tech industry, including the Age of Artificial Intelligence and the expansion of next-generation broadband.

AMD: A Leader in CPU and GPU Market Share

Rosenblatt's analysts, led by Steve Frankel, have identified Advanced Micro Devices (AMD) as a top pick for the first half of 2025. With momentum in CPU and GPU market share gains, AMD is poised for significant growth in the coming years. The company's EPYC processors are expected to drive revenue share in server and Data Center CPUs, solidifying its position in the market.

The upcoming MI350 and MI400 GPUs from AMD are forecasted to contribute to additional revenues and market share growth. With a price target of $250, Rosenblatt values AMD at a 25-times P/E multiple based on projected fiscal 2026 adjusted EPS.

Micron: Seizing Opportunities in AI and Memory Cycles

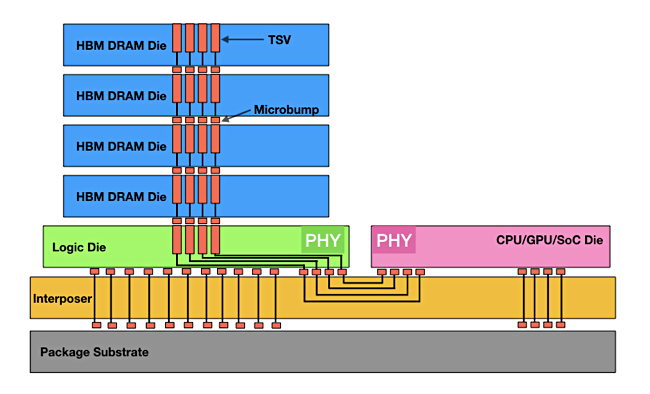

Micron Technology (MU) is also highlighted as a top pick by Rosenblatt for the first half of 2025. The company is praised for its dominance in High Bandwidth Memory (HBM), which plays a crucial role in driving AI and memory cycles. Micron's strategic positioning in the AI ecosystem is expected to yield significant benefits in the future.

Transformative Growth Opportunities in AI

According to Rosenblatt analysts, both AMD and Meta Platforms (formerly Facebook) are poised for transformative growth driven by AI technology. AMD's strong market position in CPUs and GPUs, along with its advancements in AI inference at the edge, position it favorably for future success.

Meta Platforms' revenue growth, fueled by AI-powered advertising innovations, underscores its potential in the AI-driven landscape. With projected adjusted EBITDA margins set to rise in 2025, Meta Platforms is expected to sustain its growth trajectory.

While both companies face risks in their respective sectors, Rosenblatt sees significant upside potential for investors as they capitalize on the expanding AI ecosystem. The analysis highlights the opportunities and challenges in the rapidly evolving tech industry, emphasizing the importance of strategic positioning and innovation.