Ayanti Bera : Latest News, Exclusive News Stories, Current Affairs ...

The Financial Express Financial correspondent covering start-ups and technology sector news in Bengaluru. Skilled in reporting on government policy and regulations, company earnings, M&A activities, and corporate actions as well as in-depth sectorial trends.

Ping Browser is developing an enterprise-focused browser with advanced security features, AI-driven productivity tools, and privacy controls to enhance efficiency.  Healthcare startups are set for increased mergers and acquisitions in 2025, driven by cash-strapped firms, declining revenue multiples, and investor interest. Gupshup’s CEO Beerud Sheth discusses AI adoption trends, product innovations, and the company’s growth as demand for conversational AI tools.

Healthcare startups are set for increased mergers and acquisitions in 2025, driven by cash-strapped firms, declining revenue multiples, and investor interest. Gupshup’s CEO Beerud Sheth discusses AI adoption trends, product innovations, and the company’s growth as demand for conversational AI tools.  Lab-grown diamond startups in India are rapidly expanding, aiming to capture a growing market with affordable, sustainable alternatives to natural diamonds.

Lab-grown diamond startups in India are rapidly expanding, aiming to capture a growing market with affordable, sustainable alternatives to natural diamonds.

Bengaluru-based Slikk Club

Offering 60-minute delivery of lifestyle and fashion items, raised $3.2 million in seed funding led by Lightspeed. Last year, the focus shifted dramatically to going public, thanks to the string of successful IPOs.  Overall, founders are becoming more inclined towards IPOs. Besides the expected growth in startups, Nilekani also highlighted the need for India to build open-source AI models for various applications.

Overall, founders are becoming more inclined towards IPOs. Besides the expected growth in startups, Nilekani also highlighted the need for India to build open-source AI models for various applications.

Startup Funding

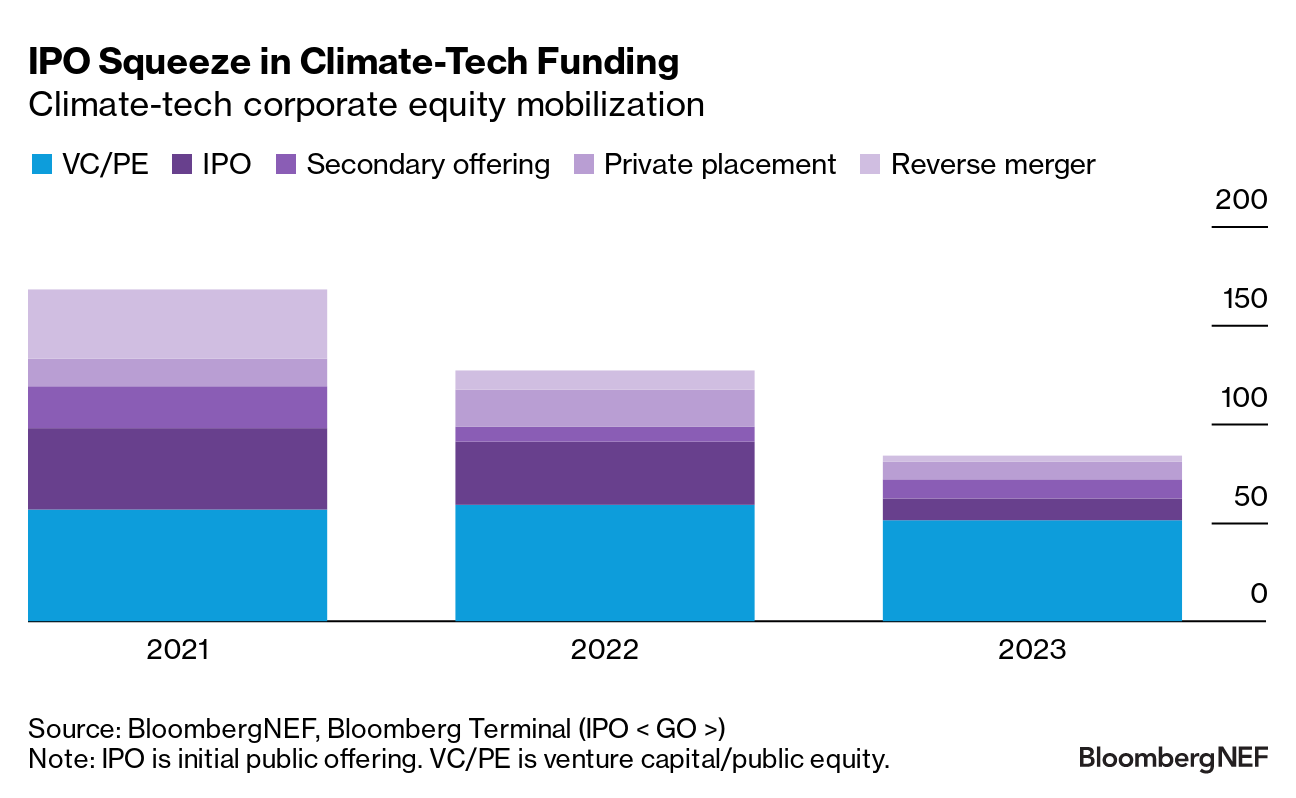

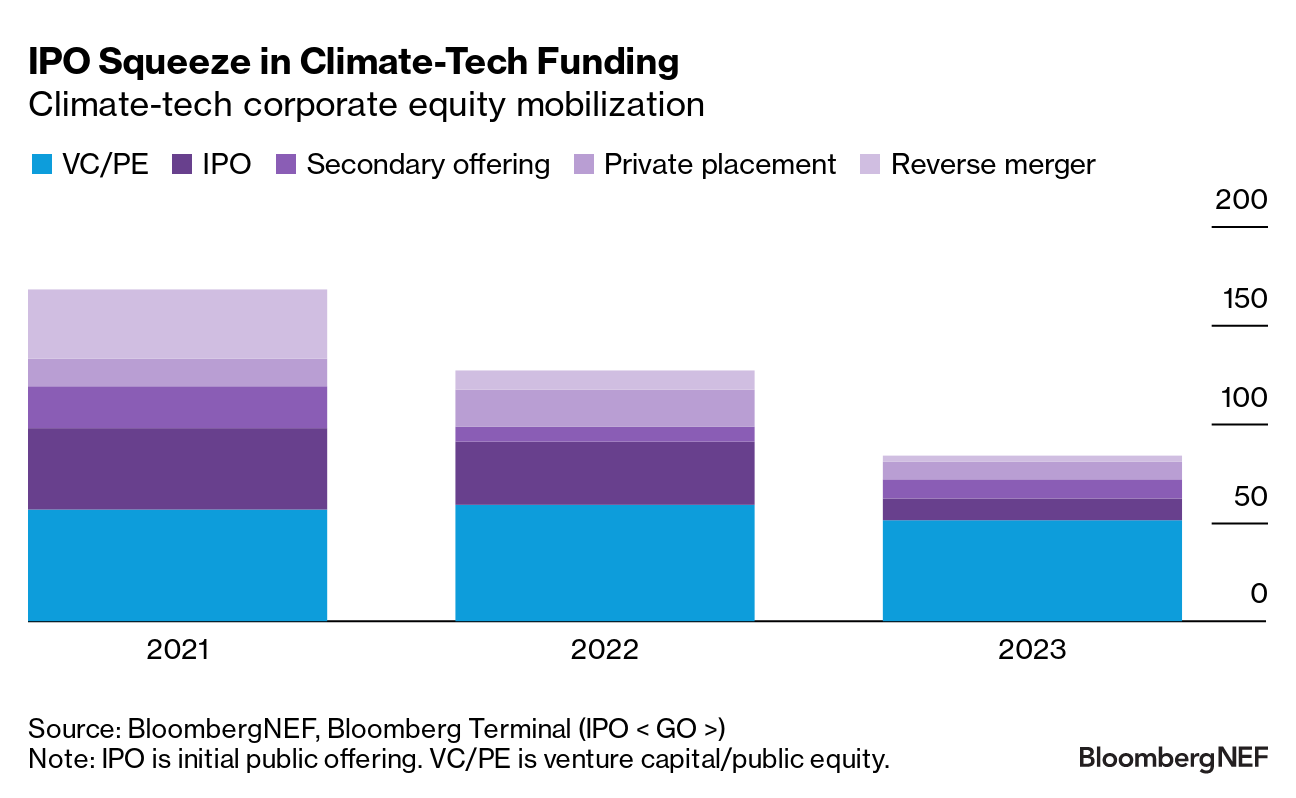

The company, which currently has $1.5 billion worth of assets under management (AUM) in India, will begin deployment of the funding. This includes capital infused in Gen AI-native companies and investment into software and AI-native companies that develop Gen AI. /tice-news-prod/media/media_files/cnQEbaeRp3C2X5w6pEwt.png) Climate-tech funding has remained a small portion of overall startup investments, with most directed toward early-stage companies, creating a gap in the market.

Climate-tech funding has remained a small portion of overall startup investments, with most directed toward early-stage companies, creating a gap in the market.

Founder Compensation and Market Trends

Typically, founder compensation carries a 20-40% premium over the highest-paid CXO, though many founders forgo salaries at later stages.  Thakur’s exit comes less than a month after Peak XV’s managing directors Shailesh Lakhani and Abheek Anand announced their exits. Budget allocations for reimbursement in FY 26 have come down to Rs 437 crore from Rs 2,000 crore in FY25.

Thakur’s exit comes less than a month after Peak XV’s managing directors Shailesh Lakhani and Abheek Anand announced their exits. Budget allocations for reimbursement in FY 26 have come down to Rs 437 crore from Rs 2,000 crore in FY25.

AI Deals and Investment Trends

AI deals are being valued at 2.5-3x of non-AI business models, making some investors concerned about the price.  Beyond fintech, B Capital is also placing bets on robotics, space technology, and advanced manufacturing in sectors such as electric vehicles. Zeta had previously been valued at a pre-money valuation of $1.15 billion when it raised $250 million from Softbank Vision.

Beyond fintech, B Capital is also placing bets on robotics, space technology, and advanced manufacturing in sectors such as electric vehicles. Zeta had previously been valued at a pre-money valuation of $1.15 billion when it raised $250 million from Softbank Vision.

Venture Capital Landscape

Venture capital in India has diversified significantly, with both global and domestic players investing. Despite tax clarity on income from Category I and II AIFs, the taxation of carried interest remains unclear, causing uncertainty in the market.