Public Storage Stock Not the Bargain It Appears | Investing.com

Public Storage (NYSE:PSA) is known for owning, developing, and operating over 3000 self-storage facilities in the US, making it the largest company of its kind in the country. With a market capitalization of $50 billion, Public Storage ranks as one of the biggest Real Estate Investment Trusts (REITs) as well.

Surge in Sales and Stock Performance

The years during the pandemic proved to be beneficial for Public Storage, as the influx of money due to government policies led people to purchase items they later realized they didn't need, necessitating storage space. Consequently, the company experienced a significant increase in sales, with growth rates of 17% in 2021 and 22.4% in 2022. This growth trajectory propelled the stock price to over $421 per share by April 2022.

The increase in sales led to  However, such rapid growth was not sustainable in the long run. As sales growth returned to a more modest single-digit pace, Public Storage stock began to decline. By the end of October 2023, the share price had dropped to just above $233, marking a nearly 45% decrease from its 2022 peak. Subsequently, bargain hunters entered the scene, assisting the stock in recovering to over $291 at present.

However, such rapid growth was not sustainable in the long run. As sales growth returned to a more modest single-digit pace, Public Storage stock began to decline. By the end of October 2023, the share price had dropped to just above $233, marking a nearly 45% decrease from its 2022 peak. Subsequently, bargain hunters entered the scene, assisting the stock in recovering to over $291 at present.

Evaluation of Stock Value

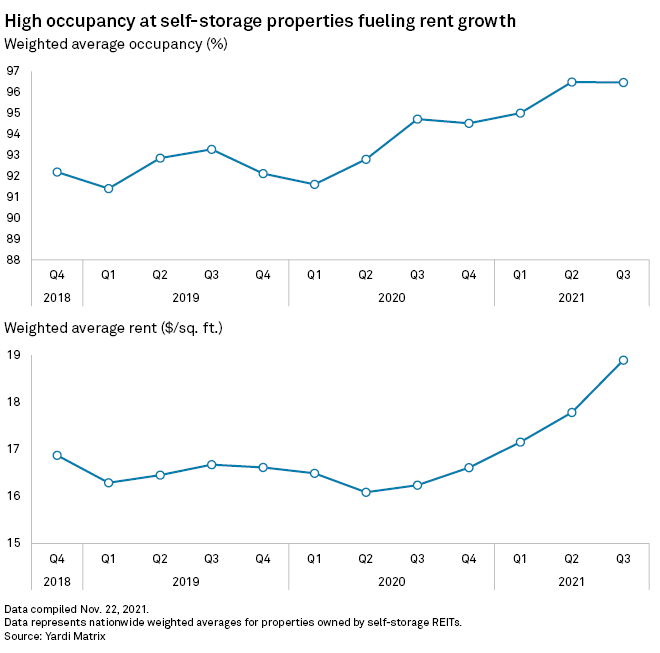

Despite the apparent recovery, the question remains: Is Public Storage stock truly a bargain? Trading at 17 times its 2024 estimated Funds From Operations, the stock may seem a bit expensive for a company with mid-single-digit growth rates and declining occupancy levels. Furthermore, the Elliott Wave chart analysis below provides additional insights.

Over the span of 32 years from 1990 to 2022, Public Storage stock exhibited significant growth, soaring from a single-digit price to over $420 per share. This journey featured a classic five-wave impulse pattern, labeled as I-II-III-IV-V. Notably, wave II coincided with the Great Financial Crisis of 2008-2009, while wave IV corresponded to the Covid-19 panic in 2020. Despite wave IV appearing larger than wave II, it only retraced 50% of the preceding third wave.

According to Elliott Wave Theory, the surge to $421.76 during the pandemic likely represented the fifth and final wave of the pattern, signaling an impending three-wave correction in the opposite direction. The subsequent 45% decline observed over the following months, however, suggests a single-wave correction rather than the anticipated three-wave movement.

Future Projections

Based on this analysis, it is probable that the corrective phase of the Elliott Wave cycle is not yet complete. Anticipated waves B up and C down are expected to occur before the resumption of the prior uptrend. Correction phases typically erase a considerable portion of the fifth wave, indicating a potential decline to below $200 in wave C, representing a significant drop from Public Storage's current standing.

For further details, you can refer to the original post.