Meta's SWOT analysis: AI investments power stock as analysts eye...

Meta Platforms Inc (NASDAQ: META) continues to attract bullish sentiment from Wall Street analysts, who see the social media giant's massive investments in artificial intelligence as a key driver of future growth. With a market capitalization of $1.57 trillion and impressive gross profit margins of 81.5%, Meta's dominant position in digital advertising and ambitious AI initiatives have analysts setting price targets in the $600-$700 range. According to InvestingPro data, the company's strong financial health score of 3.35 reflects its robust market position.

Financial Performance

Meta has delivered strong financial results that have exceeded expectations. In its most recent quarterly report, the company achieved revenue growth of 23.06% year-over-year, reaching $156.23 billion in the last twelve months. The company's return on equity stands at an impressive 36%, while maintaining a healthy return on invested capital of 27%. Analysts at Cantor Fitzgerald noted that Meta's revenue growth remains well above the digital advertising industry average, driven by engagement with Reels/Video content and increasing adoption of its advanced advertising tools.

Future Outlook

Looking ahead, Meta is expected to sustain revenue growth above a mid-teens compound annual growth rate (CAGR) over the next 2-3 years. Based on InvestingPro's Fair Value analysis, the stock appears slightly overvalued at current levels, though its strong financial metrics and growth prospects continue to attract investor interest. Analysts project revenues to grow from $134.9 billion in fiscal year 2023 to $186.3 billion in fiscal year 2025. Meanwhile, GAAP operating income is forecast to increase from $46.8 billion to $74.2 billion over the same period.

AI Investments

However, Meta's aggressive investments in AI and computing infrastructure are expected to pressure margins in the near term. The company has signaled plans for "significant growth" in capital expenditures for fiscal year 2025, which will likely lead to higher depreciation and amortization expenses. Some analysts have lowered their bottom-line estimates for 2025-2026 to account for these increased costs, even as they raise revenue projections.

AI Strategy

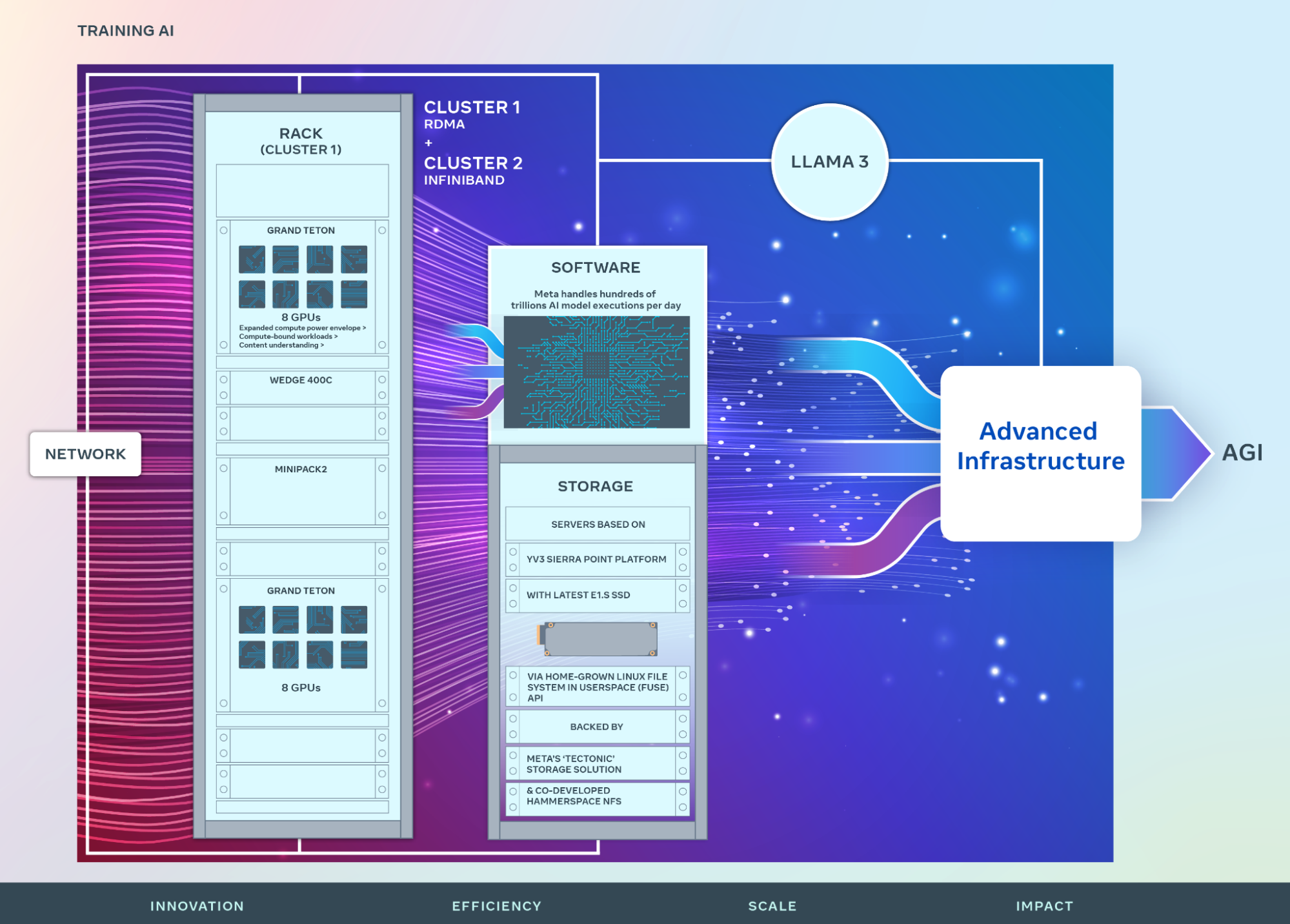

Meta's artificial intelligence strategy has become a key focus for investors and analysts. The company is making substantial investments in AI compute infrastructure, with plans to expand its capacity to over 2.5 million GPUs in the next 2-3 years. This massive build-out is aimed at keeping pace with state-of-the-art large language models and supporting Meta's ambitious AI initiatives.

Competitive Landscape

Despite concerns about increased competition and potential economic headwinds, Meta's advertising business continues to show resilience. Analysts report strong advertising checks in recent months, with key drivers like Reels, advanced advertising products, and AI-powered recommendations contributing to robust performance. Meta is expected to benefit from increased contributions from sectors like travel and e-commerce.

Reality Labs Division

While much attention has focused on Meta's AI initiatives, the company continues to invest heavily in its vision for the metaverse through its Reality Labs division. Meta recently showcased its holographic, AI-enabled Orion glasses prototype, which some analysts view as a potential "iPhone moment" for the company in terms of creating a new computing platform.

Risks and Challenges

Meta's aggressive spending on AI infrastructure and talent has raised questions about the return on invested capital (ROIC) for these initiatives. While the potential benefits of AI are significant, there is uncertainty about how quickly these investments will translate into tangible financial gains. The company faces the challenge of balancing short-term profitability with long-term strategic positioning in the AI arms race.

Conclusion

Meta's investments in AI have the potential to significantly enhance its already formidable advertising platform. Improved content recommendations and ad targeting could lead to higher engagement rates and better conversion rates for advertisers. This, in turn, could drive increased ad spending on Meta's platforms and help the company capture additional market share.

This analysis is based on information available as of December 16, 2024, and reflects analyst opinions and projections up to that date.

Gain an edge in your investment decisions with InvestingPro’s in-depth analysis and exclusive insights on META. Our Pro platform offers fair value estimates, performance predictions, and risk assessments, along with additional tips and expert analysis. Explore META’s full potential at InvestingPro.