Zuckerberg Defends Meta's Massive AI Spend amid DeepSeek Frenzy

Meta Platforms CEO Mark Zuckerberg recently addressed the significant concerns surrounding the company's hefty investment in artificial intelligence (AI) and the impact of DeepSeek's AI model during the Q4 earnings call. The tech giant reported better-than-expected Q4 FY24 results, leading to a surge in its stock price during extended trading hours.

Meta's Aggressive Spending Strategy

Zuckerberg revealed that Meta is prepared to allocate between $114 to $119 billion in total expenses, with a substantial portion dedicated to AI investments, amounting to $60 to $65 billion for the current year. Despite investor concerns, Zuckerberg emphasized that reducing spending on AI infrastructure and GPUs is premature. He believes that these large-scale investments will yield significant returns in the future, positioning Meta as a dominant player in the AI landscape.

The DeepSeek Factor

While acknowledging the cost-efficient nature of DeepSeek's R1 model, Zuckerberg highlighted the necessity for higher server power and computing capabilities to enhance the intelligence and quality of service of AI software. He noted the shift in American AI models towards processing, inferencing, and reasoning stages, which demand substantial computing resources.

Although impressed by DeepSeek's achievements, Zuckerberg hinted at integrating some of its innovations into Meta's AI models. The company's vast user base of 3.35 billion daily active users underscores the significant infrastructure required to support its operations.

Future Endeavors and Innovations

Meta is on track to unveil its advanced Llama 4 AI model with multimodal and agentic capabilities. The company anticipates that its AI assistant, a transformative product, will attract nearly 1 billion users by the end of the year. In Q4, Meta witnessed a 21% year-over-year revenue growth and a 43% surge in net profit, with minimal impact from content policy changes on ad spending.

Looking Ahead

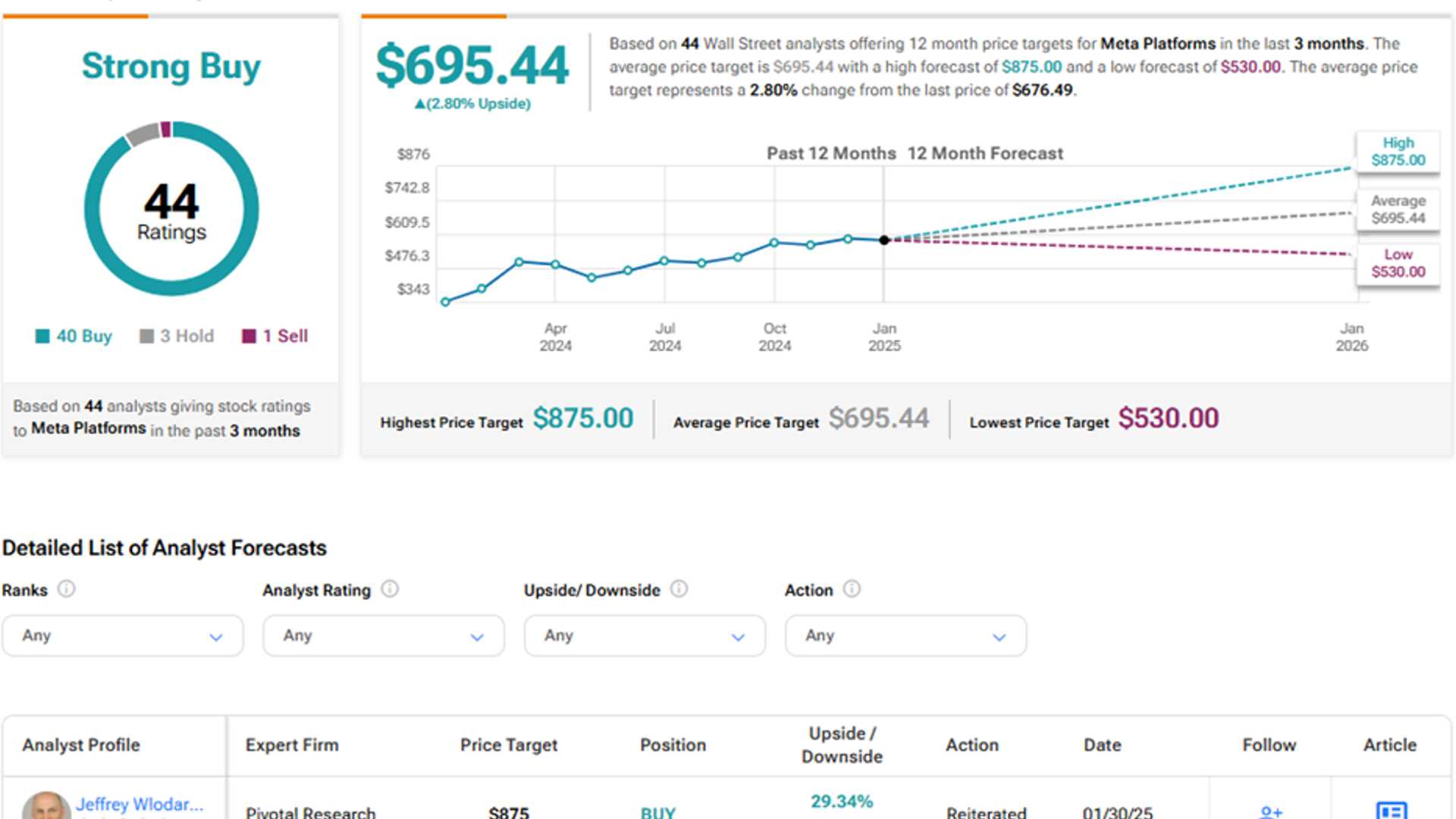

Zuckerberg remains optimistic about the global adoption of open-source AI standards in 2025, propelled by Meta's commitment to innovation. Analysts maintain a Strong Buy consensus rating on META stock, with an average price target of $695.44, suggesting a 2.8% upside potential. Over the past year, META shares have appreciated by 69.7%.

Explore more META analyst ratings