Meta forecasts higher AI spending and weaker revenue | 1470 ...

Meta Platforms, the parent company of Facebook and Instagram, faced a setback as it released forecasts of increased expenses and lower-than-expected revenue, resulting in a significant drop in its stock value. The company's shares plummeted by approximately 13% during after-hours trading, causing a loss of $160 billion in market capitalization. This decline also had a ripple effect on other tech giants, with Alphabet and Snap witnessing drops in their share prices.

Revenue and Expense Projections

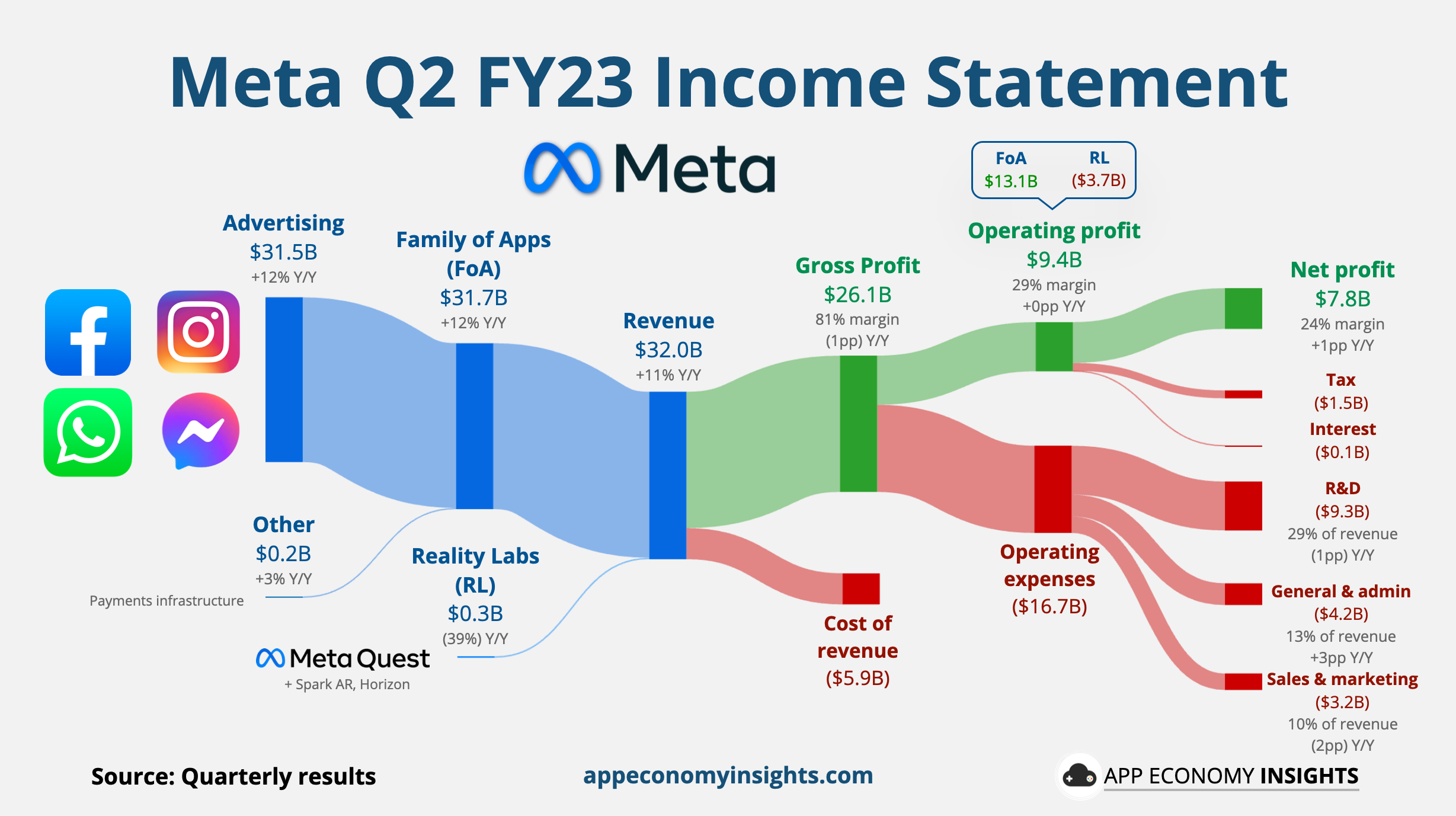

Meta projected its revenue for the April-June period to be between $36.5 billion and $39 billion, with a midpoint of $37.8 billion. This forecast fell short of analysts' expectations of $38.3 billion. The company also revised its expense forecast for the year to accommodate investments in new AI technologies and the necessary computing infrastructure. It anticipates a capital expenditure between $30 billion and $40 billion by 2024, up from the initial estimate of $35 billion to $37 billion. Additionally, Meta raised its total expense outlook to $96 billion-$99 billion.

Impact on AI Investments

The results of Meta's financial report seemed to dampen enthusiasm surrounding its AI initiatives, following a series of successful quarters for the social media conglomerate. Despite ongoing efforts to enhance revenue growth through AI-powered ad products and features, the company is facing challenges in meeting market expectations. Meta's strategic focus on AI development is critical for sustaining its competitive edge in the digital landscape.

User Growth and Engagement

Meta has been leveraging AI technologies to improve user engagement on its platforms, introducing features like a chat assistant and enhancing its ad-buying capabilities. The company's Meta AI assistant is gaining prominence across its apps, aiming to drive user interaction and platform usage. With a 7% increase in daily active users across its apps, including Facebook, Instagram, Messenger, and WhatsApp, Meta continues to prioritize user growth and retention.

Regulatory Landscape and Competition

In addition to internal challenges, Meta also benefits from regulatory developments that could impact its competitors, such as TikTok. The regulatory scrutiny facing TikTok, a Chinese-owned short video platform, presents opportunities for Meta to strengthen its market position and attract a larger user base. By navigating regulatory complexities and leveraging AI advancements, Meta aims to navigate the evolving social media landscape.

It is evident that Meta's AI strategy is intertwined with its core business objectives, particularly in the realm of advertising. As the company navigates challenges and opportunities in the digital space, its investments in AI technology will play a pivotal role in shaping its future trajectory.

🧵 Meta: Threading the Needle - by App Economy Insights

You must be logged in to post a comment. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.