GOOGL Forecast — Price Target & Prediction for 2026 — Intellectia

Based on the provided data and recent market developments, here's a comprehensive analysis for GOOGL's price trend for the next trading week:

Technical Analysis

The stock is currently trading at $183.81, showing mixed technical signals. RSI at 58.41 indicates neutral momentum, not yet in overbought territory. The stock is trading above both its 20-day MA ($189.30) and 200-day MA ($169.56), suggesting an overall bullish trend but potential short-term resistance.

Recent News Impact

Price Target Analysis

Based on current market conditions and analyst consensus:

Trading Recommendation

Short-term outlook suggests a consolidation phase with slight bearish bias:

Key Factors to Watch

The stock is likely to experience some volatility but maintain within the defined range unless there are significant regulatory developments or broader market shifts.

The price of GOOGL is predicted to go up -32.56%, based on the high correlation periods with JMSB. The similarity of these two price patterns in the periods is 98.14%.

| Year | GOOGL Price Forecast($) | Potential Return(%) |

|---|---|---|

| 2025 | 210.00 | 9.49 |

| 2026 | 250.00 | 30.35 |

| 2027 | 250.00 | 30.35 |

| 2028 | 350.00 | 82.49 |

| 2029 | 350.00 | 77.78 |

| 2030 | 350.00 | 77.78 |

GOOGL stock is predicted to reach $210 by the end of 2025, driven by strong growth in AI innovations like Gemini 2.0 and quantum computing advancements. These developments are expected to enhance revenue from Google Cloud and advertising segments, with projected double-digit growth rates. Additionally, its relatively low valuation compared to peers supports further upside potential.

GOOGL's stock price in 2026 is projected to reach approximately $250, driven by strong growth in AI applications, particularly Gemini 2.0 and Google Cloud, which are expected to boost revenue and margins. The company's valuation remains attractive compared to peers, and its leadership in AI and cloud computing positions it for sustained growth. However, regulatory challenges and macroeconomic conditions could pose risks to this forecast.

GOOGL's stock price in 2027 is projected to reach approximately $250, driven by sustained growth in AI, cloud computing, and advertising revenue. The company's advancements in AI, including Gemini 2.0 and quantum computing, are expected to enhance its competitive edge and revenue streams. Additionally, its relatively low valuation compared to peers provides room for further upside.

The price prediction for GOOGL stock in 2028 is estimated to be around $350-$400. This projection is based on Alphabet's strong growth in AI, cloud computing, and quantum computing, which are expected to drive significant revenue and margin expansion. Additionally, its current valuation and market leadership in search and advertising provide a solid foundation for long-term growth.

GOOGL's stock price in 2029 is projected to reach approximately $350, driven by sustained growth in AI, cloud computing, and advertising revenue. Alphabet's advancements in AI (e.g., Gemini 2.0) and quantum computing, coupled with its strong market position, are expected to fuel double-digit revenue growth. Valuation remains attractive compared to peers, supporting long-term upside potential.

GOOGL stock is projected to reach approximately $350 by 2030, driven by strong growth in its core advertising business, advancements in AI (e.g., Gemini 2.0), and expansion in Google Cloud. The company's leadership in AI and cloud computing, coupled with its undervalued position among peers, supports this forecast. However, regulatory risks and macroeconomic conditions could influence this trajectory.

GOOGL stock is currently trading around $190. Bulls argue that its AI-driven growth, particularly through Gemini 2.0 and quantum computing breakthroughs, positions it for long-term dominance. Analysts like JPMorgan have raised price targets to $232, citing strong cloud growth and AI monetization.

JMP Securities downgraded GOOGL to Market Perform, citing potential antitrust penalties impacting U.S. search distribution and revenue. Analysts expect limited upside until legal clarity, with a fair valuation near current levels around $191.81. Bearish sentiment stems from regulatory risks and slowing growth in key segments.

The market consensus for GOOGL's revenue in the upcoming quarter is projected to be approximately $90.007B USD. The market consensus for GOOGL's EPS in the upcoming quarter is projected to be approximately $2.028 USD. As the number of online users and usage increase, so will digital ad spending, of which Google will remain one of the main beneficiaries.

Android's dominant global market share of smartphones leaves Google well positioned to continue dominating mobile search.

The significant cash generated from the Google search business allows Alphabet to remain focused on innovation and the long-term growth opportunities that new areas present.

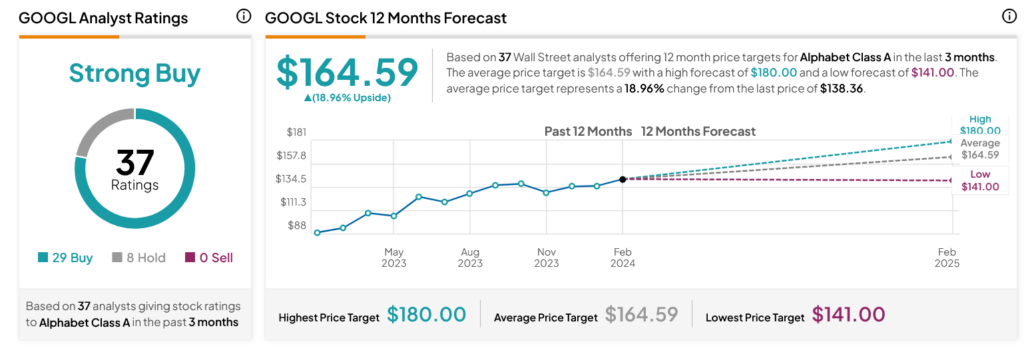

Price Targets by Analysts

- B of A Securities

Price Target: $210

Upside: +7.9% - JP Morgan

Price Target: $212 → $232

Upside: +23.14% - Bernstein

Price Target: $180 → $185

Upside: +6.04%