Meta Platforms, Inc. (NASDAQ: META) has been making waves in the stock market with a remarkable rally of +43.5%, outperforming the wider market. The company's management has been delivering expanding operating margins and improving performance metrics across its social media platforms. Despite a recent pullback due to market over-reaction to raised FY2024 capex guidance, Meta is still poised for sustainable growth in the coming years.

AI Investments Paying Off

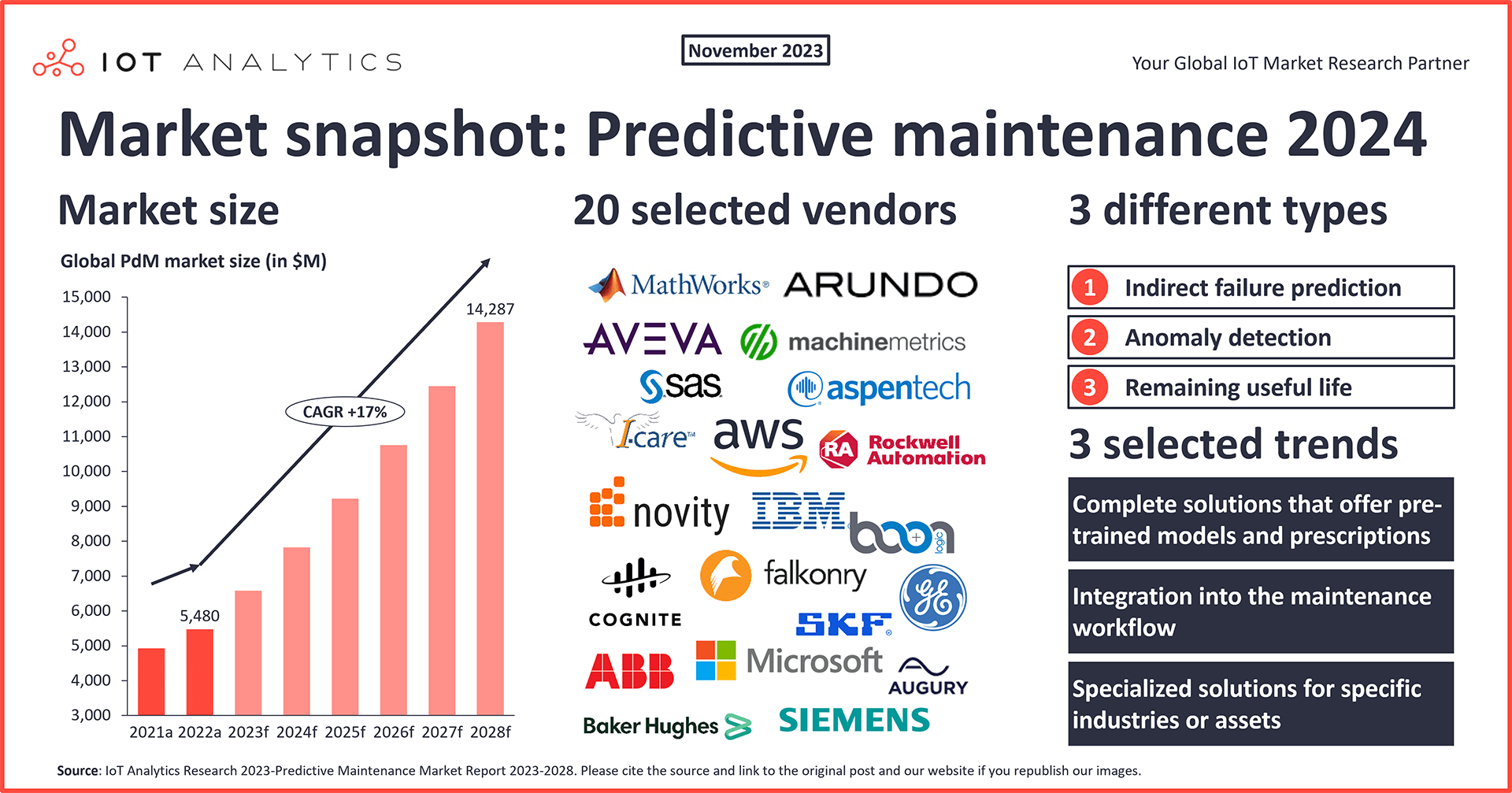

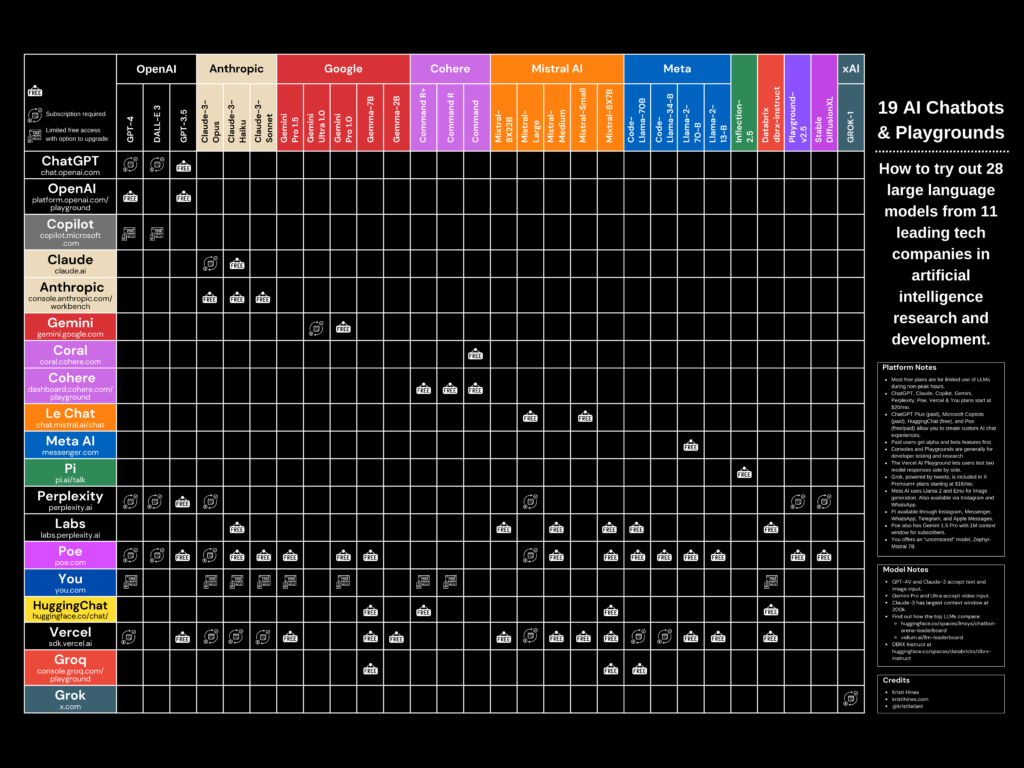

The AI investments made by Meta have shown positive results with a rebound in revenues, operating margins, and free cash flow generation. The impact of Apple's privacy changes is also fading away, allowing Meta to focus on its ambitious AI research and development efforts. The company's intense focus on AI capabilities is crucial, especially after the disruptions in ad-targeting seen in recent years.

Financial Health and Capex Guidance

Meta's FY2024 capex guidance of $37.5B reflects the company's commitment to investing in its AI roadmap. The management expects further increases in CapEx in the coming years to support their AI efforts. The company's financials remain strong with growing revenues and healthy operating margins.

Market Dominance and Competition

Despite challenges from competitors and regulatory issues, Meta continues to dominate the global social media market. The intensification of AI investments, especially in Reels and other monetization opportunities, has positioned Meta for future growth. The company's user base continues to expand, and its monetization capabilities are improving.

Investing in AI for Future Growth

It is crucial for Meta to aggressively invest in its AI and algorithms to better monetize its user base and improve ad spend returns. The company's strategic investments in AI have already shown promising results, leading to significant revenue growth and improved operating margins.

Future Prospects and Valuations

Analysts have raised their forward estimates for Meta, expecting strong top and bottom-line growth in the coming years. With favorable valuations compared to its peers and a potential upside in stock price, Meta presents an attractive investment opportunity.

Conclusion

Meta's focus on AI investments, financial health, market dominance, and future growth prospects make it a compelling choice for investors looking for long-term growth opportunities in the social media sector. Despite recent market volatility, Meta's strategic initiatives and strong fundamentals position it well for continued success.