1 Unstoppable Stock That Could Join Nvidia, Apple, Microsoft ...

The U.S. economy has an incredible track record of producing the world's most valuable companies. United States Steel became the first-ever $1 billion company in 1901, and 117 years later in 2018, Apple became the first company in the world to reach a valuation of $1 trillion. Apple is now worth over $3.7 trillion, and six other technology companies have joined it in the trillion-dollar club: Microsoft, Amazon, Alphabet, Meta Platforms, Tesla, and Nvidia. But I think another one could soon earn its membership.

Oracle: A Potential Trillion-Dollar Company

Oracle (NYSE: ORCL) was founded in 1977 and has a rich history of participating in various technological revolutions. Currently, Oracle is emerging as a key player in artificial intelligence (AI) data center infrastructure, positioning itself to potentially achieve a $1 trillion valuation in under a decade. With a current market capitalization of $492 billion, investors who purchase Oracle stock today could see significant returns should it enter the trillion-dollar club.

Large language models (LLMs) play a crucial role in AI technologies, including AI chatbots and software applications. These models require substantial computing power, particularly graphic processing units (GPUs). AI infrastructure provider Nvidia is a key supplier of powerful GPUs for these purposes.

Oracle's Innovation in AI Infrastructure

Oracle's Cloud Infrastructure (OCI) Supercluster technology enables developers to scale up to 65,000 Nvidia H200 GPUs, the highest number in the industry. The company is also in the process of creating new clusters that can accommodate up to 131,000 of Nvidia's latest Blackwell GPUs.

Additionally, Oracle's OCI utilizes random direct memory access (RDMA) technology, which facilitates faster data transfer compared to traditional Ethernet networks. This increased efficiency leads to cost savings for developers who rent computing capacity on a per-minute basis.

Oracle's Growth Trajectory and Market Position

During the fiscal 2025 second quarter, Oracle reported a substantial 336% increase in GPU usage compared to the previous year, indicating a surging demand for AI infrastructure. The company plans to expand its data center presence significantly, with the aim of building 1,000 to 2,000 new regions to meet growing market needs.

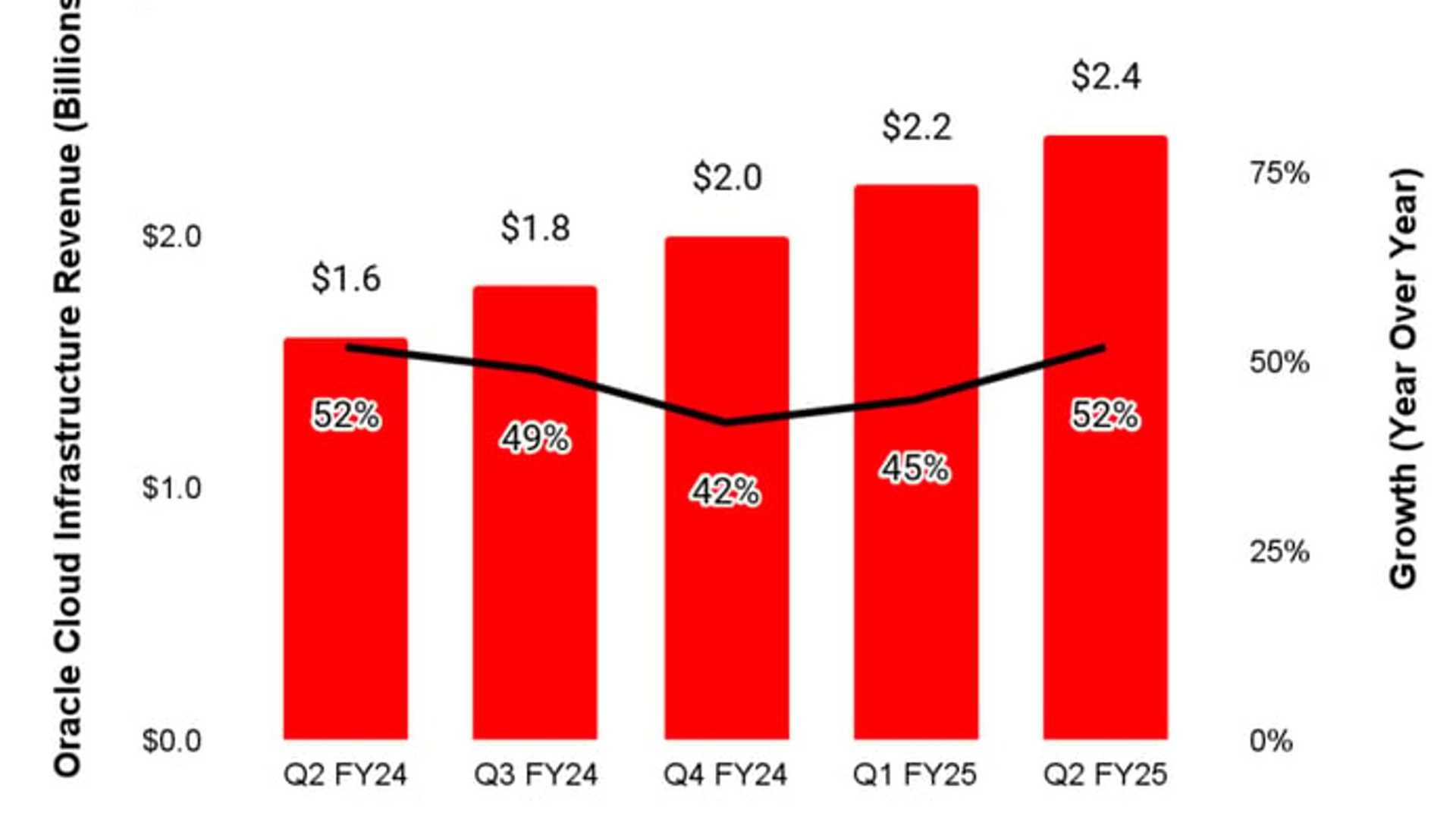

Oracle's revenue for the second quarter reached $14.1 billion, a 9% year-over-year increase. Notably, OCI revenue soared by 52% to a record $2.4 billion, showcasing accelerated growth momentum. The company's robust performance is evidenced by its increasing remaining performance obligations (RPOs), which surged 50% year over year to $97 billion during Q2.

Potential for Future Growth and Expansion

Oracle's strong financial performance and strategic positioning suggest the company's market capitalization could exceed $1 trillion within a decade, especially if it maintains consistent EPS growth. With plans to expand its data center footprint significantly, Oracle is poised for accelerated earnings growth, potentially surpassing current market expectations.

Considering Oracle's advancements in AI infrastructure and its partnerships with leading tech companies like Meta Platforms, the company is well-positioned for substantial growth and market dominance in the coming years.

Before making investment decisions, it's essential to analyze the potential and risks associated with Oracle's growth trajectory within the rapidly evolving tech industry.