Meta's advertising growth is proof that hefty AI spending is already ...

For investors who are skeptical of Meta's massive spending on artificial intelligence and whether it will pay off anytime soon, CEO Mark Zuckerberg is urging them to look to the present. Philadelphia news 24/7: Watch NBC10 free wherever you areAfter the company's better-than-expected second-quarter earnings report on Wednesday, Zuckerberg and finance chief Susan Li rattled off all the ways that AI has helped the company grow faster than the competition in the digital advertising market, Meta's core business.

Revenue Growth and Comparison

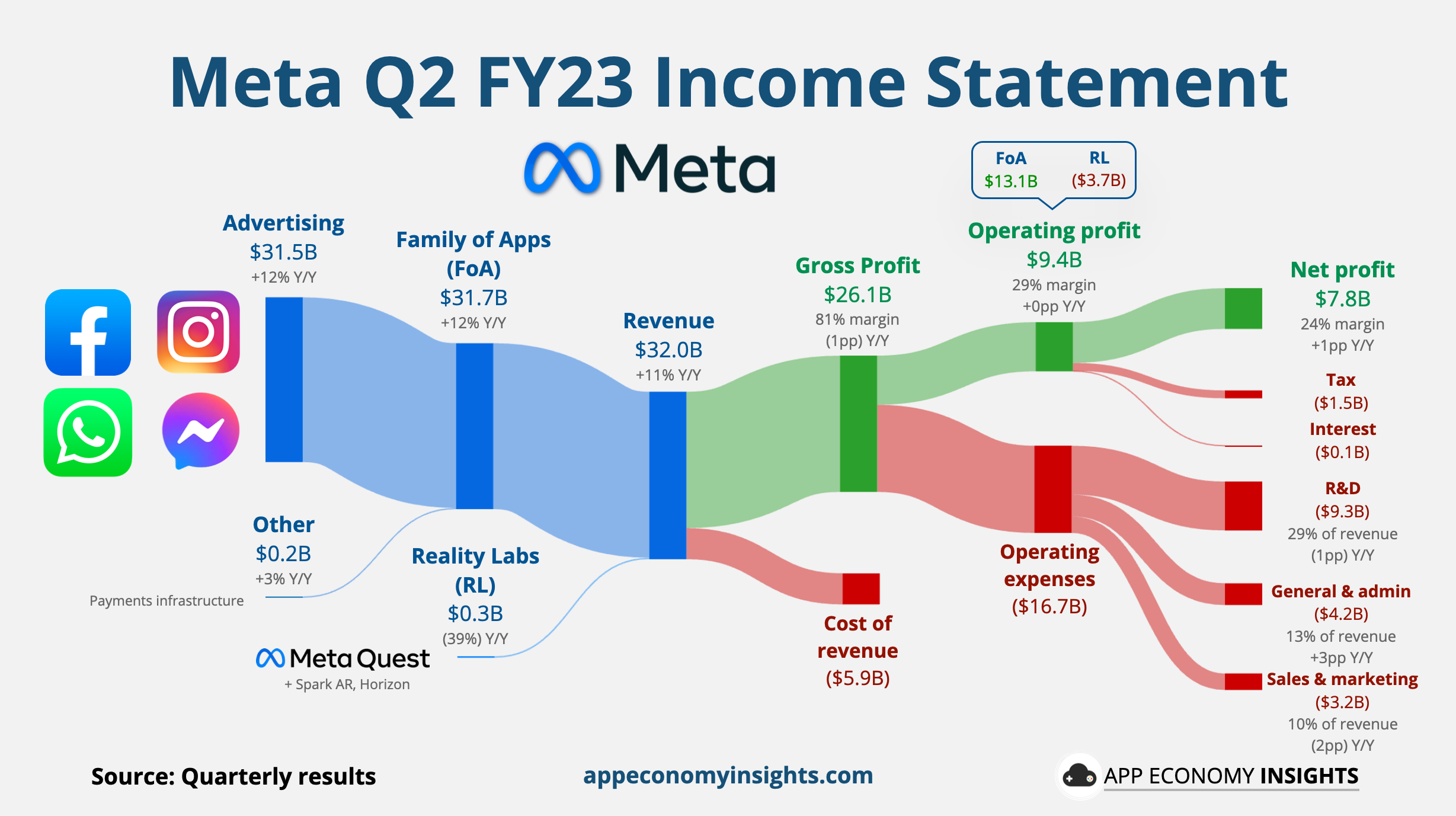

"The ways that it's improving recommendations and helping people find better content, as well as making the advertising experiences more effective, I think there's a lot of upside there," Zuckerberg said on the earnings call. "Those are already products that are at scale. The AI work that we're doing is going to improve that."Meta reported revenue growth of 22% from a year earlier to $39.07 billion, with 98% of its sales coming from advertising, primarily on Facebook and Instagram. Its growth rate was double that of Google's ad business, which saw sales increase 11% to $64.6 billion, Alphabet said in its earnings report last week. Meanwhile, Pinterest and Spotify, which are both significantly smaller than Meta, reported revenue growth of 21% and 20%, respectively, in their latest reports.

Impact of AI on Advertising

As in previous quarters, Li said Meta's advertising business benefited from online commerce, gaming, and the media and entertainment sectors, and that ad growth continued to be strongest in the Asia-Pacific region. She said the company's "improved ad performance" helped lift overall ad prices despite slowing growth in that region.

AI Integration and Results

Zuckerberg pointed to AI as the foundation behind Meta's refreshed online advertising platform, which was battered after Apple introduced an iOS privacy update in 2021.

Positive Performance and Future Investments

Meta shares popped 7% in extended trading after Wednesday's earnings report, which included an uplifting forecast for the current quarter. Like the other mega-cap tech companies, Meta is spending billions of dollars on Nvidia's graphics processing units (GPUs), which are needed to train AI models and run hefty workloads.

Long-Term Strategy and Growth

Meta is showing that, while the bet is on major growth down the road, the company is reaping rewards today. Angelo Zino, an analyst at CFRA Research, agreed that Meta has navigated concerns from a couple of years ago and is integrating AI across its ecosystem nicely, with growth rates outpacing its peers.

Meta isn't finished spending big money on AI and the far-flung metaverse, which continues to lose billions of dollars each quarter. Li said that Meta expects "significant CapEx growth in 2025 as we invest to support our AI research and our product development efforts."

AI Strategy and Revenue Expectations

For 2024, Meta said it now expects capital expenditures in the range of $37 billion to $40 billion, lifting the low end of that range, which had been $35 billion. Li says investors should think of Meta's AI strategy as a two-pronged approach, with "core AI" helping Meta improve its advertising platform and recommendation system, thus leading to more user engagement and ad performance that "have translated into revenue gains." Generative AI is a longer-term bet, opening up new revenue opportunities over time.

Overall, Meta's advertising growth and success in integrating AI into its business model indicate that hefty AI spending is already yielding tangible results, positioning the company for further growth and innovation in the future.

WATCH: Meta moving away from Metaverse Quest