Shares slump as Meta announces plan to increase AI spending

Shares in Meta slumped 15% when Wall Street opened on Thursday, wiping about $190bn off the value of the Facebook and Instagram parent company. This drop came as investors reacted to Meta's pledge to ramp up spending on artificial intelligence.

Mark Zuckerberg's Announcement

Mark Zuckerberg, Meta’s founder and chief executive, revealed on a conference call that spending on AI technology would need to grow significantly before the company could generate substantial revenue from new AI products.

Market Reaction

Meta's shares had experienced a boost in 2023 due to Zuckerberg's cost-cutting measures. However, the recent announcement of increased AI spending has unsettled investors. Meta raised the upper bound of its capital expenditure guidance to $40bn, up from $37bn.

Last week, Meta unveiled Llama 3, the latest version of its AI model, along with an image generator that updates pictures in real time based on user prompts. The company's AI-powered assistant, Meta AI, is now expanding to various international markets, including Australia, Canada, Singapore, Nigeria, and Pakistan. Chris Cox, Meta’s chief product officer, mentioned ongoing efforts to implement these changes in Europe.

Market Trends

The recent decline in Meta's share value follows a significant increase in February, where the company added $196bn to its market capitalisation in a single day after announcing its first dividend. This gain was historic on Wall Street at that time.

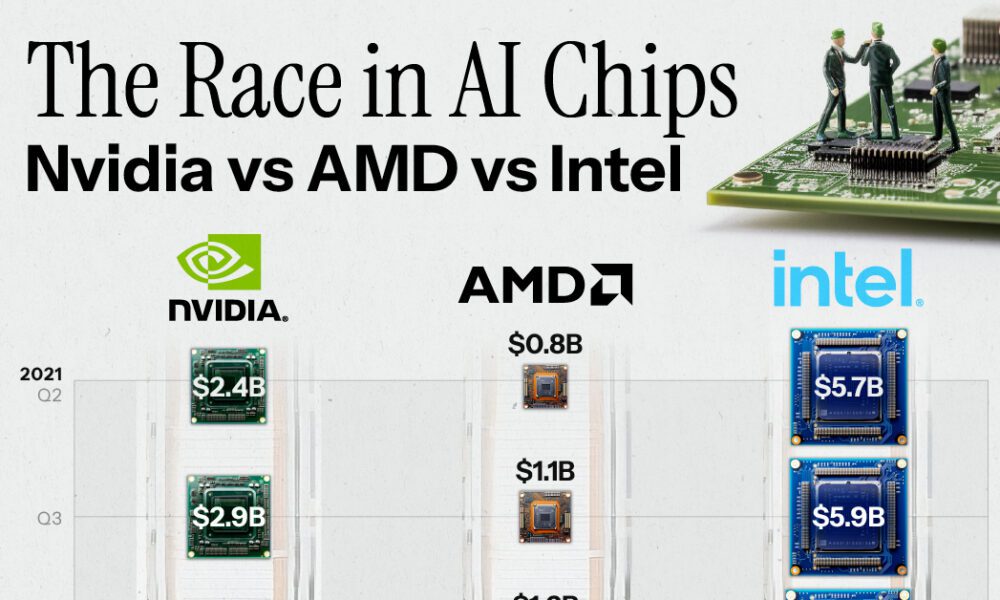

However, Nvidia, the primary chip supplier for AI models, surpassed this record with a $277bn increase in market value not long after.