Meta vs. Alphabet: Has the Tide Turned? | Saxo

Our websites use cookies to offer you a better browsing experience by enabling, optimising, and analysing site operations, as well as to provide personalised ad content and allow you to connect to social media. By choosing “Accept all” you consent to the use of cookies and the related processing of personal data. Select “Manage consent” to manage your consent preferences. You can change your preferences or retract your consent at any time via the cookie policy page. Please view our cookie policy and our privacy policy.

Meta Outperforms Alphabet in Recent Months

In the competitive landscape of tech giants, Meta Platforms (META) has recently outperformed Alphabet Inc. (GOOGL), the parent company of Google. The relative stock price of Meta vs. Alphabet has reached a 7-year high, raising the question whether Meta’s outperformance has just began, or has it gone too far?

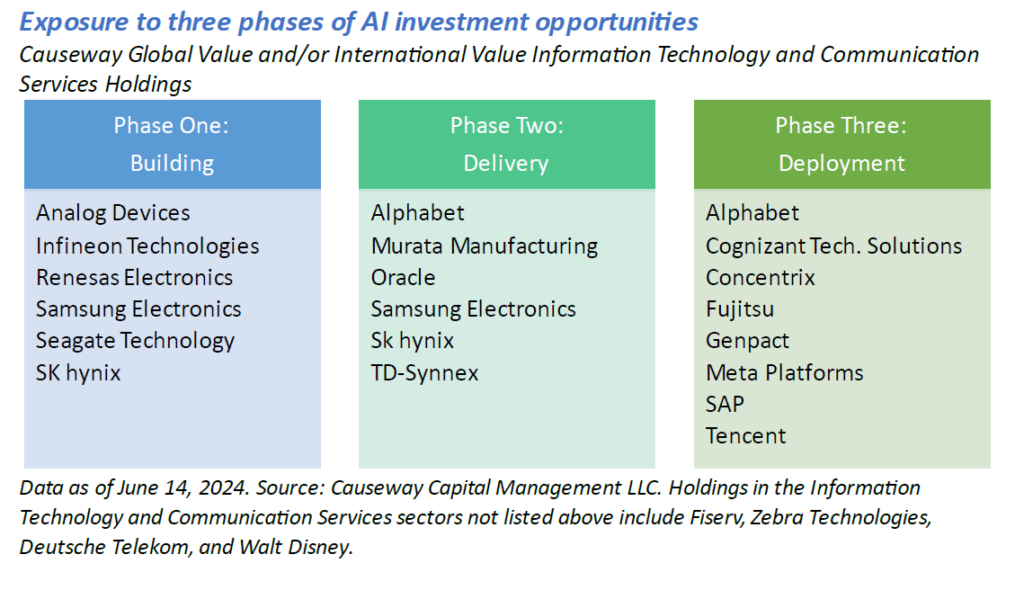

Investments in AI

Meta is pouring a massive $65 billion into capital expenditures (capex), primarily for AI infrastructure, and investors are rewarding it. The stock has surged as Meta has effectively leveraged artificial intelligence (AI) to enhance ad targeting and optimize performance, bringing tangible improvements in engagement and revenue growth.

Operating Margins and Efficiency

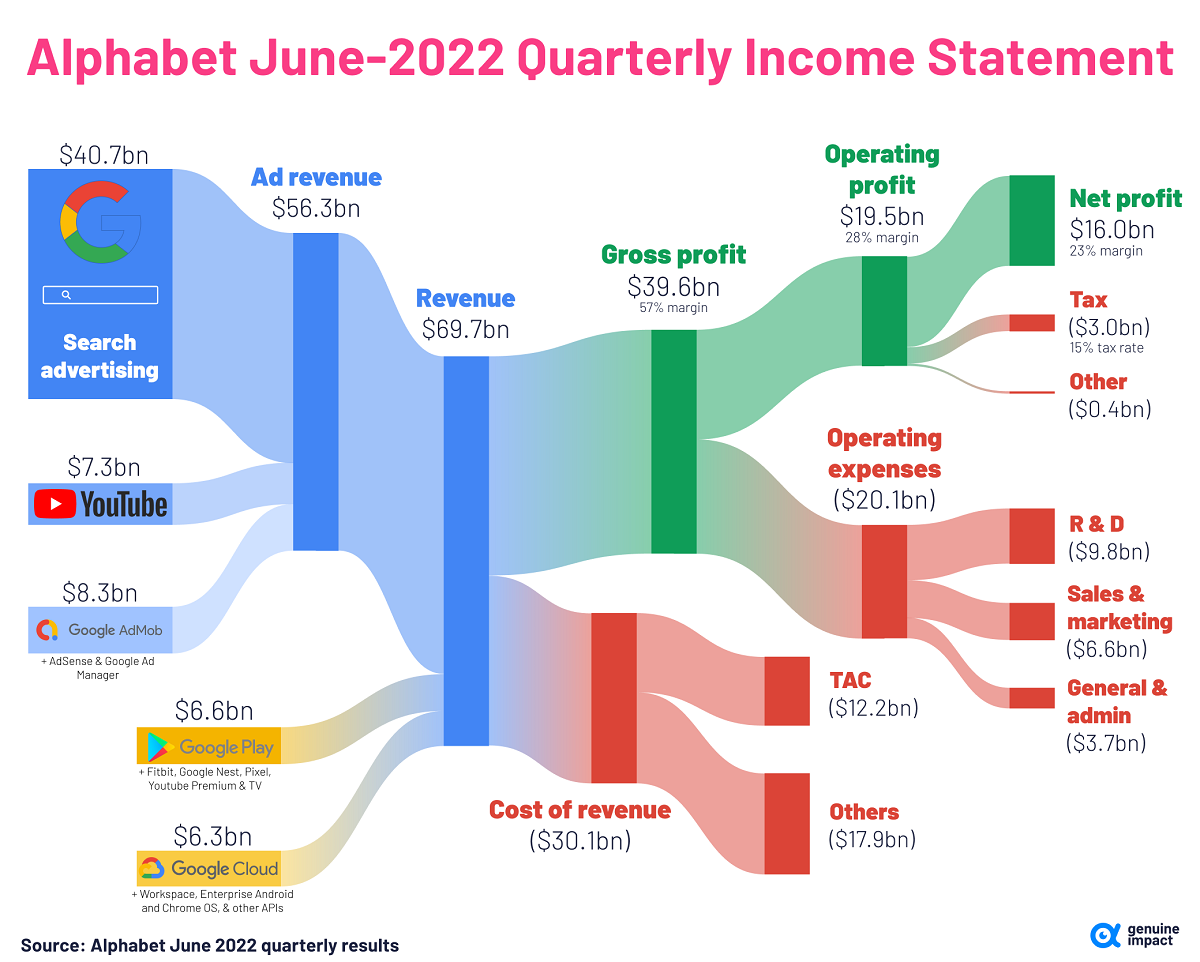

Despite its aggressive AI spending, Meta’s operating margins are soaring. Meta’s 2024 operating margin of 54% is a big jump from 41% in 2022. The company has maintained a stable ratio of capex to operating cash flow, lower than 2021 and 2022 levels, while still seeing strong earnings growth. Meanwhile, Alphabet’s capex growth in 2024 of 63% has outpaced its profit growth of 29%, a sign that its spending isn’t translating into immediate bottom-line gains.

User Engagement and Regulatory Challenges

Meta owns Facebook, Instagram, and WhatsApp, which remain dominant in user engagement. These platforms generate massive first-party data crucial for ad targeting.

Regulatory Landscape

For years, Meta was in the regulatory hot seat, facing scrutiny over data privacy and competition concerns. But in 2024, those worries largely faded. TikTok once posed a major threat, but the regulatory risks surrounding the Chinese app have largely eased.

Future Outlook

Meta has outperformed Alphabet in recent months, fueled by AI-driven ad growth, improving margins, and regulatory tailwinds. But with economic risks, rising capex, and valuation concerns, it may not have unlimited upside from here.

Alphabet, meanwhile, is at a crossroads. If AI enhances its core businesses rather than disrupts them, its lower valuation could make it an attractive long-term play. But if regulatory risks and AI cannibalization persist, it could struggle to keep up.

For now, Wall Street is favoring Meta – but the race is far from over!

Related Articles

Read more about the latest market trends and key stories:

- Key Stories from the past week: Déjà vu Monday

- The US dollar bear case

- Amazon’s Strong Q4 Overshadowed by Weak Guidance and AI Capacity Constraints

- Market Quick Take - 7 February 2025

- Global Market Quick Take: Asia – February 07, 2025

- JPY on the rise again. What is the potential?

- Market Quick Take - 6 February 2025

- Top 10 Most Read News/Articles in January