Meta Shares Plunge As Prolonged AI Spending Plans Unnerve Investors

Meta Platforms' shares plunged 14% in premarket trading on Thursday as the social media firm's comments around prolonged spending on artificial intelligence unnerved investors. The company's dour expense and revenue forecast on Wednesday sent its shares 15% lower in after-market trading. The selloff erased nearly $200 billion off the Facebook-Instagram parent's market valuation, bringing it down to about $1 trillion.

Shares of Alphabet and Snap fell between 2% and 5%. Meta narrowed its forecast for expenses this year in the range of $96 billion-$99 billion from $94 billion-$99 billion to support investments in new AI products and the computing infrastructure needed to support them. It expects the spending to continue to increase next year, it added.

Analyst Reactions

Despite a sharp investor sell-off, some analysts welcomed the move, while others had a mixed view on the extended spending. "We agree with higher investment to come as META continues to accelerate AI infrastructure investments for more durable engagement and revenue growth," said Morgan Stanley analysts, led by Brian Nowak, in a note.

Analysts at Baird had a similar take, saying, "Meta’s report reminds us that sustaining growth through innovation requires investment cycles; and in our view, it would be foolish for (the company)...to ignore meaningful opportunities created by technology shifts for the sake of shorter-term financial outcomes."

CEO Insights

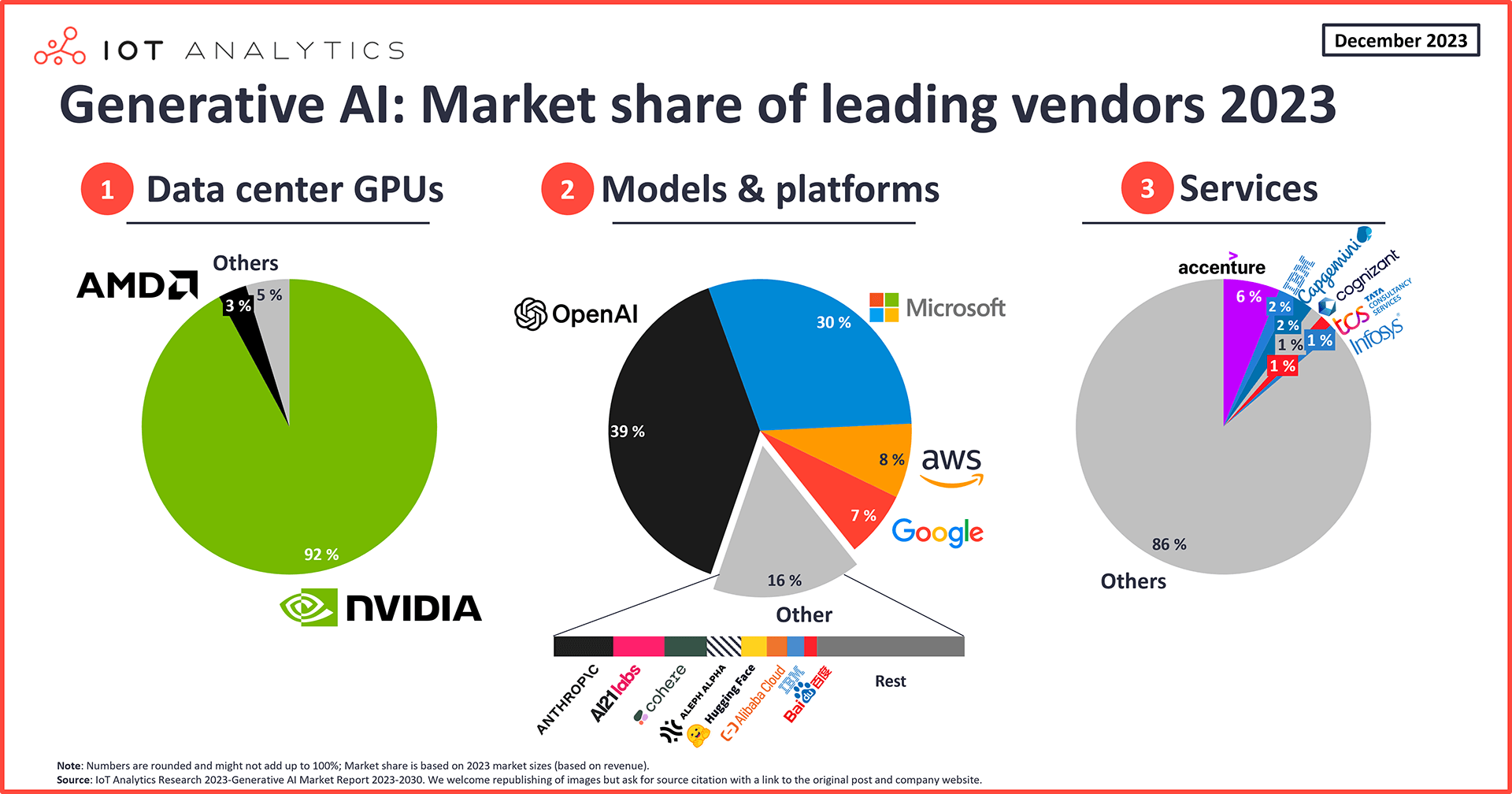

Meta, a forerunner in the race to catch up to generative AI market leader OpenAI, has been updating its ad-buying products with AI tools and short video formats to boost revenue growth as well as introducing new AI features like a chat assistant. CEO Mark Zuckerberg told analysts on a conference call that the focus on AI would "grow our investment envelope meaningfully before we make much revenue from some of these new products."

Zuckerberg's comments and the quarterly results tempered expectations for revenue from Meta's AI investments, after a series of smash-hit quarters driven by ad revenue at the social media giant.

Market Perspective

"To the degree an investor doesn't believe in AI's transformative capability in both engagement and utility, the story could be looked upon as lacking the next-big-thing type of growth driver," RBC analyst Brad Erickson said in a note. Meta has gained nearly 40% so far this year, comfortably above the benchmark S&P 500 index's 6% gain.