Decoding the trillion-dollar market moves of Meta, Alphabet, and Amazon

While it is self-apparent that Fed’s rate cuts lead to cheaper cost of capital, it matters why the rate cuts were implemented in the first place. If the underlying reasoning stems from a weakened economy, aimed at stimulating it, history suggests a market downturn is likely after rate cuts. Such downturns can significantly impact the performance of trillion-dollar stocks, as these market giants often react sharply to macroeconomic signals.

Wharton School economy professor, Jeremy Siegel, noted in April that given the choice between rate cuts or a strong economy, “it’s no contest, a strong economy is better for the stock market.” It appears that Fed Chair Jerome Powell is aware of how hypersensitive the market is. After the latest FOMC meeting, he noted that “if you just set policy at a restrictive level, eventually you will see real weakening in the economy.”

Meta Platforms (META)

Over one year, Meta Platforms (NASDAQ:META) has been one of the most consistently performing Magnificent 7 stocks. In that period, the company’s market cap increased by 90%, from $679 billion to $1.29 trillion. Excluding Reality Labs for VR/AR content, Meta’s underlying business has remained strong.

The integration of AI algorithms into its social media platforms and ad management has further boosted Meta’s deep ecosystem between Instagram, Facebook, WhatsApp, and Messenger. By linking with Bing and Google search results, Meta’s AI assistant (Llama 3) is also shifting the SEO game. In other words, Zuckerberg’s Meta continues to be an indispensable part of the internet landscape.

Alphabet (GOOG, GOOGL)

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) has come under scrutiny during the Gemini launch fiasco. Much has been revealed about the company’s isolated culture with strong ideological commitments and the decision to proceed with a product previously criticized by insiders as “a pathological liar.”

Alphabet could face significant challenges during an economic downturn as businesses reduce their marketing budgets. In antitrust proceedings, it was outlined that “advertising revenue is what drives Google’s monopoly power today.” Despite these challenges, Alphabet’s financial performance remains robust.

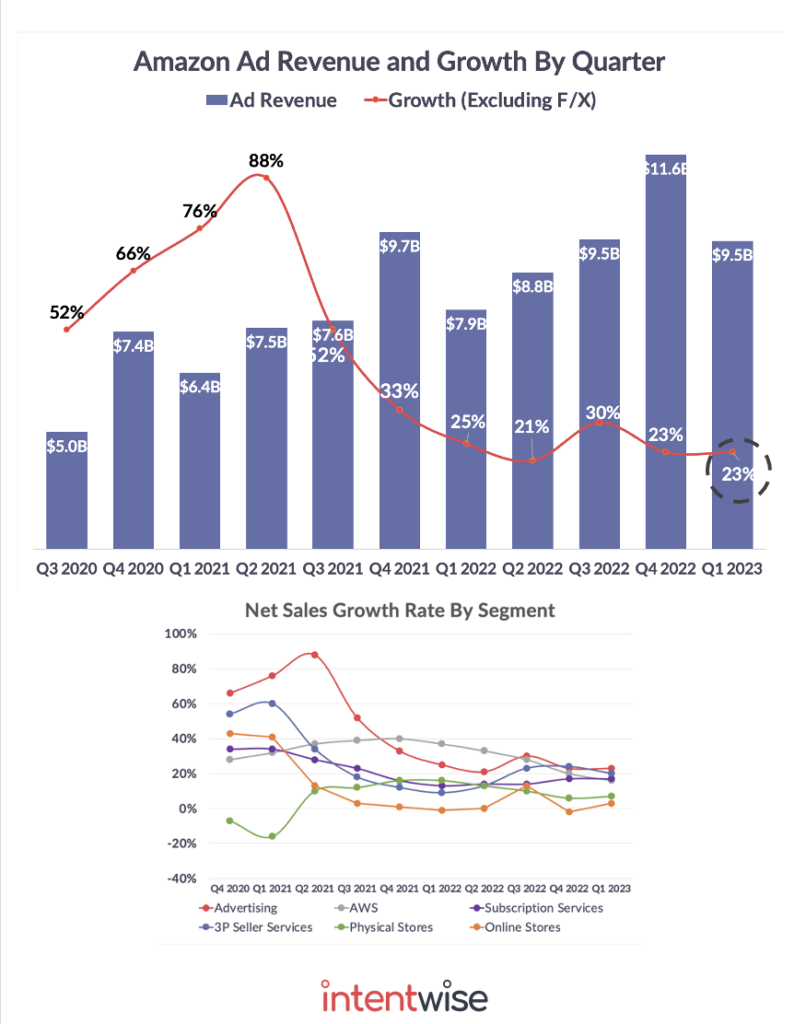

Amazon.com (AMZN)

The reduction of economic activity suppresses both Amazon sales and its cloud AWS network. Amazon grew substantially owing to its strong diversification across e-commerce, digital services, and cloud computing. AMZN shareholders saw the company’s valuation grow by 50% over one year, from $1.3 trillion to $1.94 trillion. At the present price of $186 per share, AMZN stock is 21% above its 52-week average price of $153.58.