Meta Platforms' Revenue Jumps as It Plans to Invest Big in AI. Is the Stock Still a Good Investment?

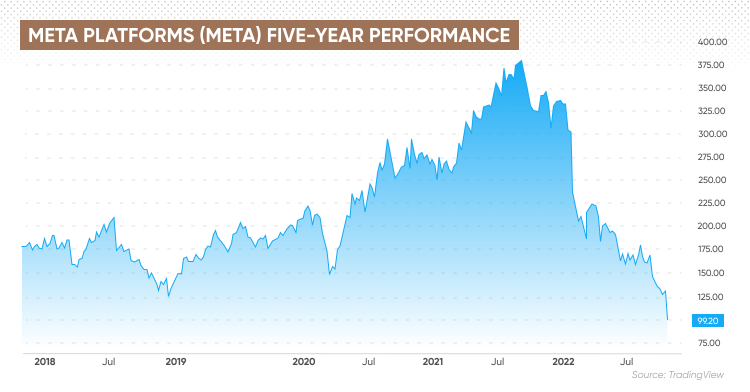

Meta Platforms' (NASDAQ: META) share price surged following the release of strong fourth-quarter results, reaffirming its position as a top destination for users and advertisers on social media. The company is continuing its significant investment in artificial intelligence (AI) technologies. In 2025, the stock has already seen a 17% increase.

Strong Q4 Earnings and Guidance

In Q4 2024, Meta reported a 21% year-over-year increase in revenue to $48.4 billion, with advertising revenue also up 21% to $46.8 billion. Despite a 1% rise in Reality Labs revenue to $1.1 billion, the segment still reported a $5 billion loss. Operating income from social media apps saw a 35% surge to $28.3 billion, while earnings per share (EPS) jumped 50% year over year to $8.02, surpassing analyst expectations.

The company also experienced growth in family daily active people (DAP) and family average revenue per person (ARPP). Impressively, ad impressions and average ad prices both increased, showcasing Meta's ability to attract more users and enhance monetization through advertising.

Future Investments in AI and Growth Forecast

Meta forecasts a first-quarter revenue between $39.5 billion and $41.8 billion, with full-year 2025 capital expenditures expected to range from $60 billion to $65 billion, a significant increase from 2024. The company plans to direct a large portion of these investments towards expanding AI capacity and data centers to capitalize on its strategic advantages.

Mark Zuckerberg, Meta's Founder and CEO, envisions Meta AI evolving into a leading AI assistant globally. The company's investments in custom AI chips and AI infrastructure are aimed at improving efficiency and service quality, with a target of reaching 1 billion active Meta AI users by the end of the year.

Market Outlook and Valuation

Despite concerns over AI spending and semiconductor chips, Meta remains committed to its AI investment plans, believing it will provide a competitive edge in service quality and scalability. With strong engagement levels and monetization capabilities, Meta continues to be a top contender in digital advertising.

From a valuation perspective, Meta's stock trades at a forward price-to-earnings (P/E) ratio of under 24 based on 2025 estimates, making it an attractive investment option considering its revenue growth and solid business model.

Conclusion

As one of the leading digital advertising companies with a focus on AI, Meta Platforms is positioned to be a long-term winner. The company's ongoing investment in the metaverse adds additional potential. At current levels, Meta's stock appears to be a compelling buy for investors looking for growth opportunities in the tech sector.