Watch These Alphabet Stock Levels After Report Google Parent ...

Alphabet (GOOGL) shares will be focus on Monday after the Wall Street Journal reported Sunday that the Google parent is in advanced discussions to acquire cybersecurity startup Wiz for around $23 billion, citing people familiar with the matter. If the deal were to proceed, it would mark the tech behemoth’s largest ever acquisition.

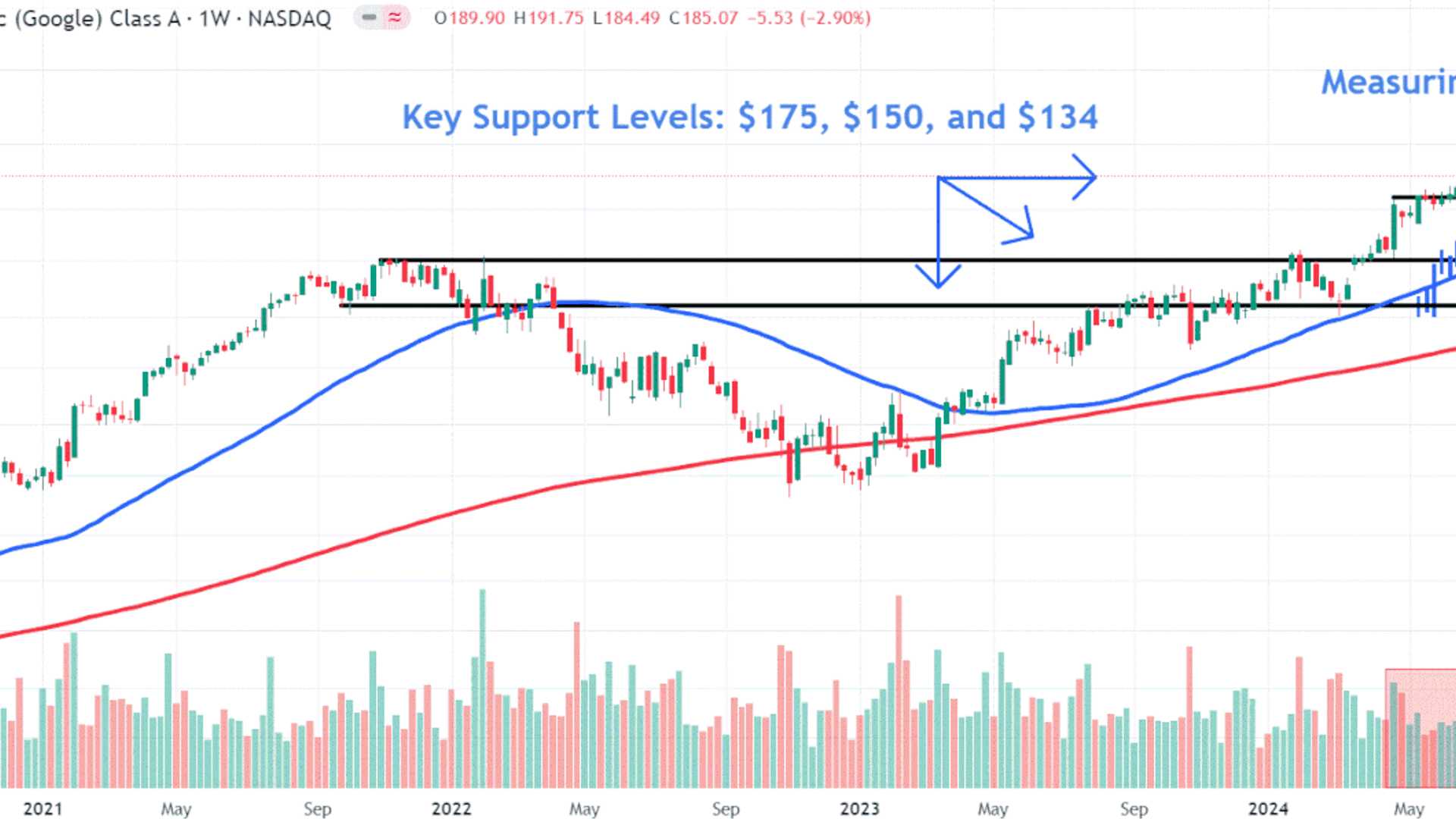

Alphabet's Weekly Chart Analysis

Since bottoming out around the 200-week moving average (MA) early last year, Alphabet shares have continued to trend higher, with investors promptly buying the dips.

Key Stock Support Levels

The first area to watch sits at $175, where the shares may attract buying interest near a series of similar prices between late April and early June.

A close below this level could see a retest of the $150 area, a region likely to attract buyers near the rising 50-week MA and a key horizontal line linking several prior record highs in the stock from November 2021 to January this year.

Potential Price Target

To gauge a potential longer-term upside price target, we can take the a bars pattern from the stock’s upward move between March last year and January this year and overlay it from the March swing low. This projects a target of around $215, an area where the stock may face selling pressure, especially if other technical indicators point to overbought conditions at the same time.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.