OpenAI Considers Building Its Own Web Browser to Challenge Google

OpenAI, the parent company of ChatGPT, is reportedly exploring the development of a web browser to rival Google's dominance. This initiative comes in the wake of the U.S. Department of Justice's pressure on Google to divest its Chrome browser.

Development Plans

The Information reported that OpenAI is in discussions with various app and website developers, including Conde Nast, Redfin, Eventbrite, and Priceline. The proposed browser aims to integrate seamlessly with OpenAI's chatbot technology. Additionally, OpenAI is looking to power search functionalities across different sectors such as travel, food, retail, and real estate.

Furthermore, OpenAI is in talks to provide AI capabilities for Samsung Electronics Co.'s devices, a significant partner of Google. This strategic move aligns with OpenAI's existing partnership with Apple Inc., where it enhances the "Apple Intelligence" features on the latest Apple devices.

Market Impact

OpenAI's foray into the search domain with its SearchGPT product has caught the attention of industry players. The tightening grip of Google on the search market has faced regulatory scrutiny, with the DOJ recently highlighting Google's control over Chrome as a potential antitrust concern.

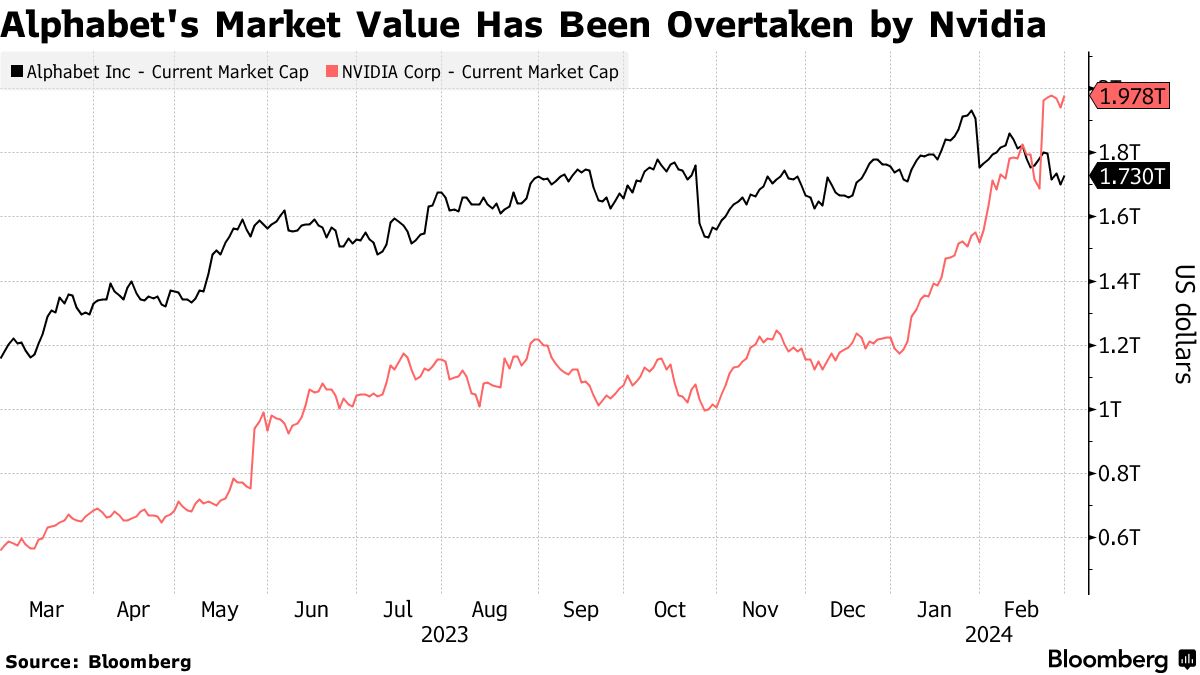

Following these developments, Alphabet Inc.'s shares experienced a significant decline, losing over $120 billion in market value in a single trading session. This downturn pushed Alphabet's market capitalization below the $2 trillion threshold, positioning it as the fifth most valuable company globally, trailing behind Nvidia Corp., Apple, Microsoft Corp., and Amazon.com Inc.

Strategic Partnerships

Microsoft's substantial investments in OpenAI were partly driven by concerns about falling behind Google's advancements in AI. Since 2019, Microsoft has injected approximately $14 billion into the ChatGPT-parent company.

Stock Performance

On the stock market, Alphabet's Class A and Class C shares experienced a notable decline, with Class A shares ending at $167.63 and Class C shares closing at $169.24. In after-hours trading, both classes of shares saw further reductions in value.

For more insights on consumer tech and market trends, explore Benzinga's comprehensive coverage on this topic.