Every Meta Platforms Stock Investor Should Watch This Key Number ...

Last week, America's biggest banks kicked off earnings season for the September-ended quarter. But Wall Street is waiting to hear from the trillion-dollar technology giants that currently lead the artificial intelligence (AI) race, because they tend to deliver much stronger revenue and earnings growth than the rest of the market.

Meta Platforms (NASDAQ: META)

Meta Platforms is scheduled to report its results for the third quarter on Oct. 30. Besides analyzing the company's financial performance, investors will be looking for fresh information about its AI strategy. However, Meta will report one number relating to AI that might be more important than the rest.

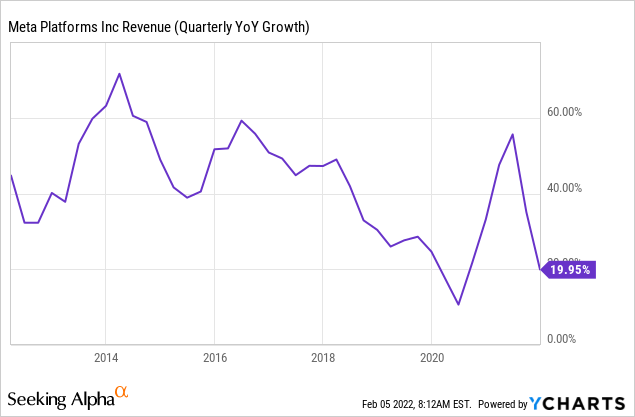

Meta is home to popular social media platforms Facebook, Instagram, WhatsApp, and Messenger. Facebook and Instagram generate revenue by selling advertising slots to businesses, so the more time each user spends on those apps, the more money Meta makes. AI has become a powerful tool for boosting engagement. It learns what each user likes to see so Meta can feed them more of it, which in turn keeps them online for a longer period of time.

Plus, Meta is giving businesses new AI tools to help them craft more engaging ad content to boost conversions. When businesses see strong results, they are inclined to spend more money. The company also launched a free virtual assistant earlier this year called Meta AI. It's capable of answering complex questions, generating images, and it can even join your group chat on WhatsApp and Messenger to settle debates.

AI Chatbots and Large Language Models

Meta AI paves the way for new chatbots like Business AI, which will give every merchant an AI agent capable of handling incoming queries from customers, and even processing sales. Meta AI is powered by the company's own large language model (LLM) called Llama.

Capital Expenditures and Earnings

Building data centers and filling them with chips from suppliers like Nvidia isn't cheap, and spending can quickly climb into the tens of billions of dollars. Each quarter, Meta CFO Susan Li provides investors with a forecast for how much the company plans to allocate to capital expenditures (capex) -- most of which now relates to AI infrastructure.

Meta's capex forecast for 2024 has already increased three times. Li's initial guidance suggested spending would come in between $30 billion and $35 billion for the year, but that range had climbed to $37 billion to $40 billion by the second quarter. Investors should look out for yet another upward revision.

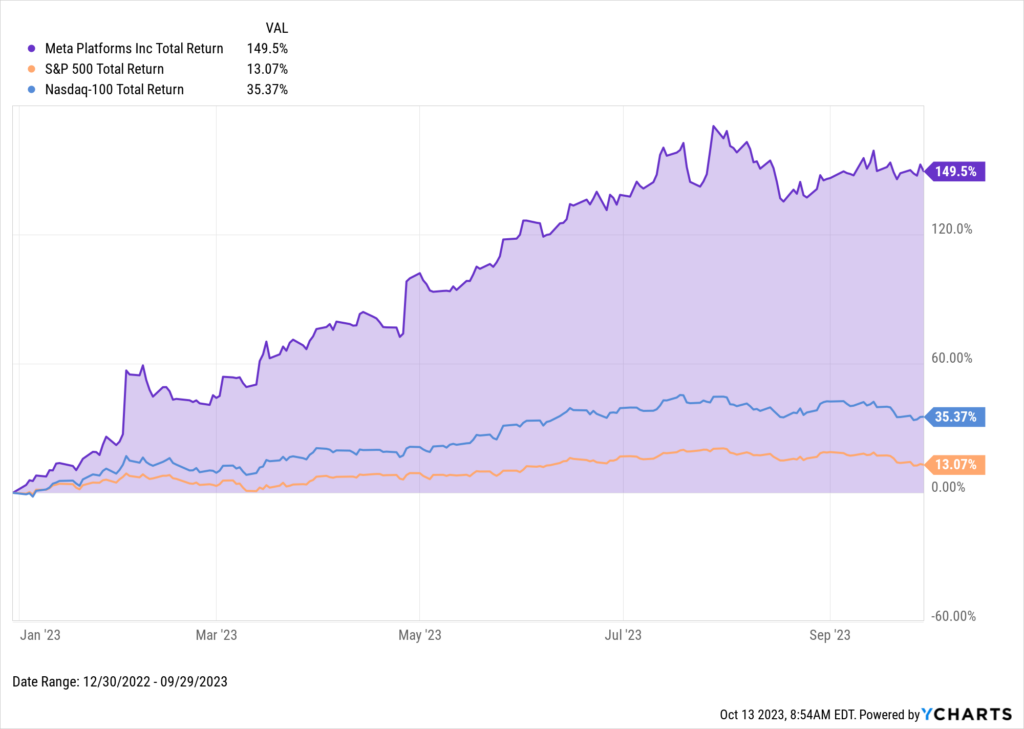

Future Outlook and Stock Performance

Meta's business model is very different to Microsoft's or Amazon's, for example. Those two companies are also spending tens of billions of dollars on AI data centers, but they rent them out to businesses and developers who use the computing capacity to build AI software.

As I touched on earlier, Meta is primarily using its data centers to build its Llama LLMs, and since they are open-source, they don't create an immediate revenue stream. Capex is important to monitor because it's a headwind for Meta's earnings per share.

If Meta's earnings flatten out or start to shrink from here, it could be a sign that the financial payoff from Llama (and AI in general) isn't big enough to justify the company's spending at this stage.

Conclusion

Meta stock is heading into its Oct. 30 report at a price-to-earnings (P/E) ratio of 29.4, which is a discount to the 32.1 P/E ratio of the Nasdaq-100 index. Before you buy stock in Meta Platforms, consider the potential risks and rewards associated with its AI investments and future outlook.