Amazon Plans Huge AI Spends to Stay in the Race with Big Tech ...

Amazon is planning massive investments in the AI domain in this quarter and next year to stay current in the AI race along with the other big tech. Let’s look at the details.

E-commerce behemoth Amazon.com (AMZN) has planned to spend huge sums on artificial intelligence (AI) to stay in the race with the big tech companies. Amazon is spending both directly and indirectly on AI models, software, and physical infrastructure. Its most recent $4 billion investment in AI start-up Anthropic is an example of how Amazon is ensuring it does not fall behind in the AI race.

Amazon's Investments in AI

With up to $8 billion invested in OpenAI’s rival, Amazon is now the primary supplier of cloud services to Anthropic. The latter uses AWS (Amazon Web Services) chips (Trainium) to run its AI models such as its AI assistant Claude. Anthropic claims that Claude is better than ChatGPT-4o and Google’s Gemini 1.5 Pro for a series of tasks, including writing, coding, reading charts, solving complex math, and text-to-image generation. Interestingly, Amazon’s founder was also an angel investor in another AI startup Perplexity AI.

Amazon plans to spend a total of roughly $75 billion on AI efforts in Fiscal 2024 and even more in 2025, especially toward generative AI. Last year, the company spent $48.4 billion toward capex. During the Q3 FY24 earnings call, CEO Andy Jassy noted that spending on AI is a “once-in-a-lifetime type of opportunity.”

At the same time, Amazon is spending billions on its AWS cloud business, since it is the major operating profit contributor for the company. The Trainium chips are used for deep machine learning (ML) purposes and inference. Amazon even announced an investment of $110 million for supporting universities that are engaged in research and development of generative AI using its Trainium chips.

Big Tech's AI Investments

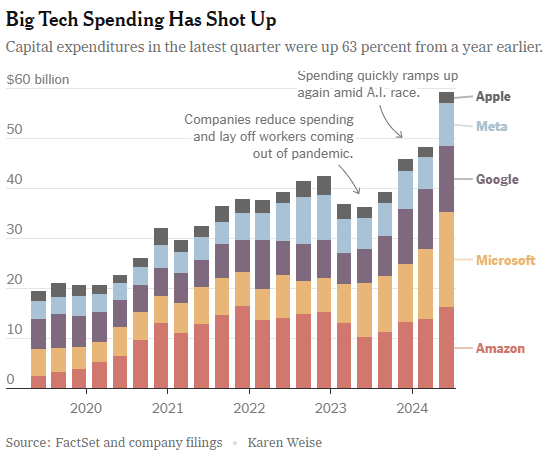

Collectively, the big four tech companies Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), and Amazon spent a staggering $60 billion in capital expenditures in Q3. The figure shows a 59% jump compared to the capex in Q3FY23. Importantly, this figure is expected to exceed $200 billion by the end of Fiscal 2024. Another report suggests that the Magnificent 7 stocks, which also include Apple (AAPL), Nvidia (NVDA), and Tesla (TSLA), are expected to invest a combined $500 billion into AI research and capital expenditure in 2025.

Wall Street is indeed optimistic about Amazon stock’s trajectory. On TipRanks, AMZN stock commands a Strong Buy consensus rating based on 45 Buys and one Hold rating. The average Amazon.com stock price target of $239 implies 16.2% upside potential from current levels. Year-to-date, AMZN stock has gained 35.4%.