Meta loses nearly $200 billion in value after Mark Zuckerberg AI announcement

Meta, formerly known as Facebook, has seen a significant decrease in its market value following an announcement by CEO Mark Zuckerberg regarding the company's investment in artificial intelligence. The company's shares dropped by almost $200 billion, representing a 15% decline in value.

AI Investment Challenges

In a recent report released by Meta, it was revealed that the company is facing higher costs and lower-than-expected revenues due to its substantial investment in AI technology. Despite Zuckerberg's optimism about the long-term potential of AI, he acknowledged that it may take several years for these investments to yield substantial returns.

:max_bytes(150000):strip_icc()/Clipboard01-2678bfb63dab487680dd9c782aa16ce3.jpg)

Zuckerberg emphasized the various avenues through which Meta aims to monetize its AI products, including business messaging, targeted advertising, and premium AI services. He also highlighted the role of AI in enhancing user engagement and advertising effectiveness on Meta's platforms.

Market Reaction

The market reaction to Meta's AI investment strategy was swift and severe, with investors expressing concerns about the company's future profitability. This negative sentiment not only impacted Meta's stock price but also influenced the share prices of other tech giants such as Snap, Alphabet, Amazon, and Microsoft.

Despite the short-term market turbulence, Zuckerberg remains confident in Meta's AI initiatives and their potential to drive significant revenue growth in the future. The company is exploring various monetization options within its AI ecosystem, aiming to create a sustainable and lucrative business model.

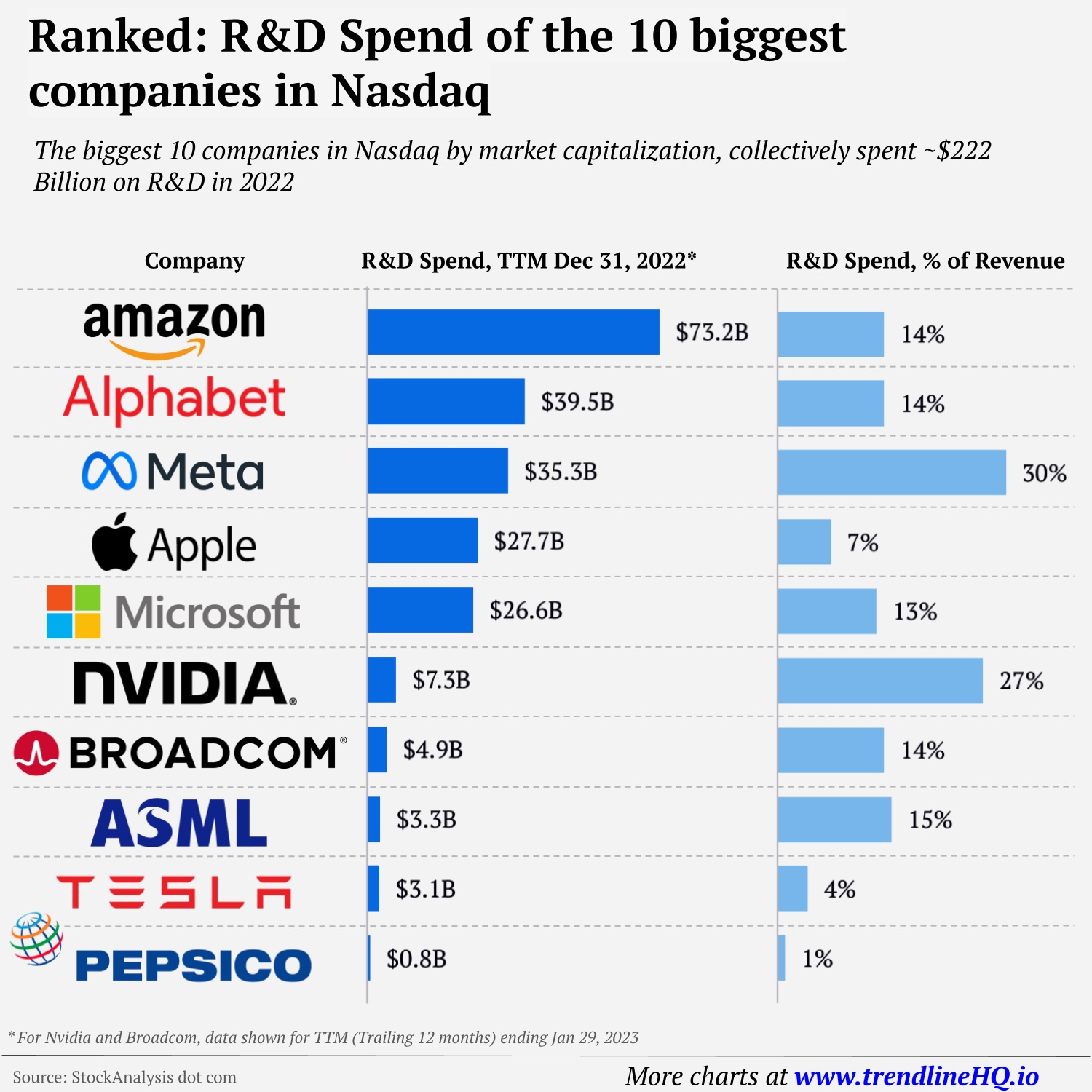

Visualizing R&D Investment by the 10 Biggest Nasdaq Companies

As Meta continues to navigate the evolving landscape of artificial intelligence and tech innovation, the market will closely monitor the company's progress and financial performance in the coming years.

For more updates on Meta's AI investments and market developments, stay tuned to Meta and Mark Zuckerberg.